Your portfolio is facing challenges from depreciating asset values.

Make Gold in Your IRA a Reality

While the current market environment continues to prove quite challenging for investors, a strategic allocation to gold can provide long-term returns and lower overall portfolio volatility.

World Gold Council research shows that most portfolios can benefit from an allocation to gold. The duality of gold as both an investment asset and a commodity means that it delivers long-term returns in both good and bad economic environments when included in a diverse portfolio. See below...

You can also include precious metals like gold, silver, platinum and palladium in an Individual Retirement Account (IRA)!

We have been assisting clients in making it a reality since the IRS code first allowed gold and silver starting in 1986. Thanks to the Taxpayer Relief Act of 1997, which broadened the permissible investments allowed in IRAs, we have been able to make holding all four precious metals in an IRA a reality for our clients for a long time.

Individual and corporate tax returns must be filed for the 2024 tax year by April 15, 2025. You MUST make your 2024 contribution by that date, but you can also make your 2025 contribution at the same time, if you wish.

For each year, the total annual contributions to your Traditional and Roth IRAs combined cannot exceed: $7,000 if you are under age 50, or $8,000 for those ages 50 or older. Traditional IRA contributions are not limited by annual income, and are tax deductible for the year of the contribution.

This way, you can roll forward some of your contribution room, even over multiple years. This is particularly useful for those of you expecting income increases in the next year or so.

Roth IRAs

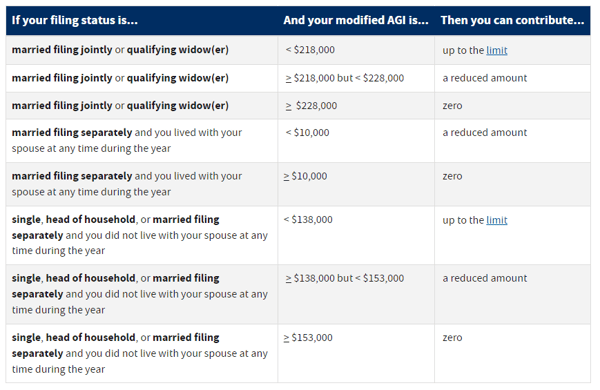

Roth IRA contributions are after tax dollars. Consider also that adding precious metals to a Roth IRA will carry additional benefits since you won’t have to pay taxes on the gains. However, there are limits and eligibility rules based on your modified adjusted gross income, which also vary depending on tax-filing status as follows:

Don't Forget

The Traditional IRA is tax deferred, not tax exempt. After you turn 72 years of age, you are forced to take distributions. At that point, funds in your traditional IRA must begin to be withdrawn, and ordinary income tax must be paid on the withdrawal.

Alternative Assets in Your IRA

The Internal Revenue Code allows IRAs to own certain gold, silver, platinum and palladium bullion (coins and bars) so long as they meet the London Bullion Market Association (LBMA) minimum standards of fineness. In general, precious metal bullion and coins that are 99.9% pure or better are eligible for IRA investment, but we can help guide you when it comes time to make your purchase.

Precious metals are perfect for an IRA because they are for long term investing and so is your retirement plan.

But, you must have a self-directed account that follows carefully controlled IRS rules and restrictions. Specifically, your precious metals cannot be held by you directly; they must be held through an IRA administrator in an approved depository.

Also, beware of anyone insisting you need a "Gold IRA", there are no such defined terms under the Internal Revenue Code. Any investor may make use of open/existing self-directed IRA accounts with an IRA trustee/custodian. High pressured sales tactics are signs that you should slow down and ask more questions.

Another great way to own gold in an IRA is the Perth Mint Certificate. ASI has been working with several trustees/administrators for decades to help clients take advantage of the industry's best kept secret. Your gold, silver or platinum is held offshore in Perth, Western Australia and is guaranteed for safety by the Government of Western Australia and is fully insured at full market value at all times… at their expense.

Give us a call at 1-800-831-0007 or email us to discuss your precious metals IRA options. We're less than a month away from Tax Day, so don't delay!

*Asset Strategies International is neither a financial advisor nor a tax advisor. Consult your CPA or Tax Attorney today before making any decision.