| Perspective

By Rich Checkan

This incredibly successful experiment known as America celebrated its 247th birthday a couple days ago.

I hope you all spent quality time with family and friends and contemplated the incredible sacrifices that were made 247 years ago and since to keep this amazing country surviving and thriving.

I know we have our issues – as all countries do – but if you think this country has been anything other than successful for the past nearly two and a half centuries, you are completely mistaken.

I was emailing back and forth last week with my good friend and fellow veteran, Jim Woods. Here we are at Mt. Rushmore a couple years ago…

We both agreed that we were extremely lucky. We both won the lottery of birth… being born in this great nation. And we further agreed we would not want to be from anywhere else.

Jim joins us with some excellent commentary this month… as do Bill Bonner and Frank Holmes.

But before we get to our guests, I wanted to share a comment from a long-time client in response to last week’s Thursday email alert. I am glad he shared it with me because I believe he isn’t alone in his thoughts and in his frustration.

“The investment thesis is broken.”

Shortly after last Thursday’s email alert hit inboxes, I received an email citing this particular comment from our article…

“Everyone should be adding hard assets to their portfolios RIGHT NOW to protect against what is to come.”

Our good client and good friend said the following in response…

“False. Gold investors have been waiting for inflation for 40 yrs. We finally get it and gold doesn’t react. Investment thesis is broken. Price going lower. A lot lower.”

I right away thanked him for sharing his frustration because I know he is not alone. Then, I shared two quick thoughts with him…

“1/ The inflation thesis isn’t broken. We have had inflation for decades. When I joined ASI in 1996, gold was considered expensive in a range from $250 to $400. Today, “expensive” gold is $1,800 to $2,000. Inflation is all around, and gold is doing its part to keep up and protect purchasing power.

2/ When I hear such comments from long-time precious metals owners like you, the contrarian in me wants to buy gold with both hands… not just with one.

Keep that allocation for insurance. It really has never failed those who have.”

Zoom Out

I said what I said to our good friend and valued client because of what I see all around us.

And make no mistake. This is not chicken little sky is falling fear mongering. It is reality.

We have no fiscal responsibility whatsoever. We inflate the money supply to deal with lack of restraint in spending. We lessen the purchasing power of every U.S. dollar in circulation. Over time, it takes more “worth less” dollars to buy sugar, gas, homes, eggs, and yes… an ounce of gold.

Not opinion. Pure fact.

To see it, simply zoom out.

Right now, day to day, gold’s lack of price strength can be quite unnerving for gold investors. With no ceiling on how much Congress can overspend through 2025, shouldn’t the gold price be stratospheric?

It should be… and it will be eventually.

When you pan out to look at what the gold price has done since President Nixon decoupled gold and the U.S. dollar in 1971, there is no mistake whatsoever that inflation is very real, and that gold combats inflation extremely well.

I’ve been in this industry for a little over half those 52 years since President Nixon closed the gold window. In just that time, the price of gold has gone up significantly… as I shared in response to our frustrated client above.

Don’t get caught-up in the short-term price movements. They can be incredibly puzzling and frustrating.

Zoom out, and know that gold continues to do its job… as it has for 5,000 years…

Next Steps

You already know my next thought. I shared it above.

When believers in gold lose faith, it is time to buy with both hands. Back up the truck for gold. I expect the worm will turn as we emerge from this summer’s seasonal doldrums.

Next, enjoy the insights this month from Jim, Bill, and Frank. They always give me food for thought.

And finally, join us – either in person or virtually – at these upcoming conferences…

FreedomFest 2023, “the Soul of Liberty” in Memphis, TN, July 12-15

The Rule Symposium of Natural Resource Investing in Boca Raton, FL July 23-27

Both conferences will be jam-packed with the brightest investment minds. They are the perfect opportunities for you to ask those questions you’ve been meaning to ask, to get the answers you have been seeking.

Simply follow the links provided, and we will see you there.

And, as I remind everyone in my weekly video updates… "Getting Rich" starts with keeping what’s yours. Protecting your wealth from erosion is simply done by owning gold (and silver too). It is the best store of purchasing power known to man.

Simply zoom out, and you will have no doubt.

Call us at 800-831-0007 or send us an email today so we can help.

—Rich Checkan

Editor's Note: Jim Woods is a 20-plus-year veteran of the markets with varied experience as a broker, hedge fund trader, financial writer, author and newsletter editor.

Feature

Rejecting Waco Market Mavens

By Jim Woods

I recently watched the television miniseries “Waco,” a dramatized exploration of the 51-day standoff in 1993 between the Federal Bureau of Investigation (FBI), the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) and the “Branch Davidians,” a religious cult led by the messianic and self-proclaimed “Lamb of God,” David Koresh. I highly recommend this show, as it was an intensely interesting examination of what happens when very bad delusory ideas collide with incompetent and overreaching government use of force.

The way I see this sad episode in American history is that both sides of this conflict were at serious fault, and the result was bad for the Branch Davidians, the government and ultimately every American. Indeed, in the follow-up series, “Waco: The Aftermath,” (which I also recommend) we learn how the events at the Branch Davidian compound were the genesis for the horror that was the Oklahoma City bombing by Timothy McVeigh.

Watching the “Waco” series and the fervent and emphatic end of days prophecies that David Koresh preached reminded me of many of the wild, hyperbolic and fear-focused marketing prognostications in my own industry, the financial newsletter/advice business. You see, when you want someone to buy what you are selling, one very good way to do this is to aggressively scare them into action.

You know the promotions I’m talking about. “The End of America” by one of my rival publishers is perhaps the best-known example of this, but there are many others. I call these promos, and those who advocate for them, doom-and-gloom merchants, but I think a better term for them is “Waco market mavens.”

These Waco market mavens want to convince you that the world is about to end, and that you are going to lose all of your money — and that the only thing that can save you from financial Armageddon is to cough up a couple of hundred dollars a year for their publication.

Okay, before we go on, I understand the appeal of such dire predictions. I mean, doesn’t everyone fear an end-of-the-world scenario where civilization collapses, money is no longer of any use, and people resort to pillaging others and eating one another’s flesh to survive? This is the ultimate fear, and it is why so many books, films and TV series are created to dramatize this kind of dystopian world. The best of this genre from a literary standpoint is Cormac McCarthy’s, “The Road.”

Yet while a dramatization of these fears might be good subject matter for fiction, it is NOT a way to invest in the financial markets.

Fear of loss might be a way to get you to buy someone’s advice, but if that advice is for you not to invest in the greatest wealth-building mechanism ever devised, then you are simply a sucker that’s fallen prey to bad ideas. Another way to put it might be you’ve been seduced by the likes of a financial David Koresh.

Think about it this: What end times prognostication, or what doom-and-gloom financial prediction, has ever come to pass?

The answer is… none.

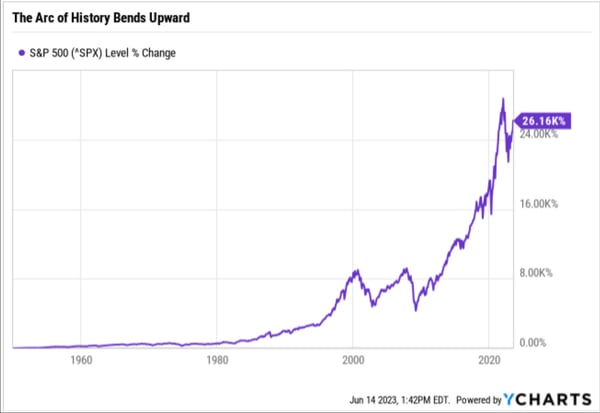

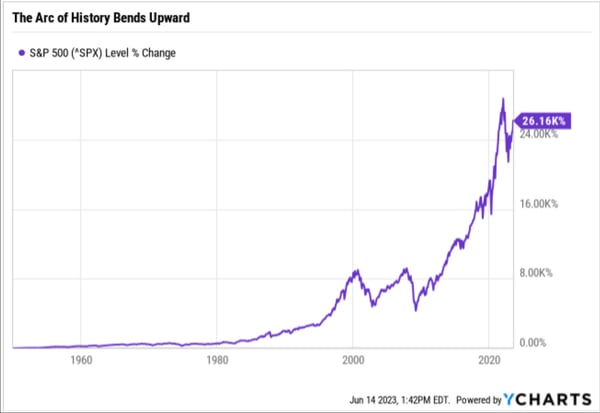

We currently live in the most prosperous, safest, and healthiest time the world has ever seen. And if you don’t believe me, check out the work of Harvard psychologist Steven Pinker in his seminal book, “Enlightenment Now.” As for things in the financial markets, stocks now are quickly approaching all-time highs on the S&P 500 Index.

Perhaps a visual here will make my point even more forcefully. Take a look at the S&P 500 since 1950. As you can see, the arc of history bends upward, and no matter how closely you look, I defy you to locate Armageddon on this chart.

Now, is this to say that markets always go higher? Of course not. Bear markets are real. In my nearly 30 years in this business, there have been some very destructive periods of market selling. This reality must be respected, but it also must be accepted as part of the cost of doing business.

Markets, to be commanded, must be obeyed, and I don’t want you to think that I’m bullish all the time. That would be as equally bad an error as the one made by the doom-and-gloom, Waco market mavens, albeit in the opposite direction.

Perhaps most importantly, as an investor you need to own not just stocks and bonds, but also precious metals. And you need to own those precious metals not in the form of a financial instrument such as an exchange-traded fund (ETF) or a mining stock. Here you need to own physical metals, coins, bullion, etc., as this asset class is a must for wealth preservation and as wealth insurance. And, of course, the best way to do that is through my friends at Asset Strategies International.

Finally, what I really want you to take away from my thoughts here is that listening to the merchants of fear is a prescription for paralysis — not just in terms of your money, but in terms of your life and your happiness.

If you want to live a wealthy life, not just fiscally but also psychologically, emotionally and intellectually, I advise you to reject the Waco market mavens and embrace the reality of a benevolent universe. Much more happiness, truth, beauty, wisdom and wealth will come to you that way.

Editor's Note: Frank Holmes is the CEO of U.S. Global Investors —a company that produces quality analysis concerning gold, precious metals, natural resources, and emerging markets—in conjunction with his work as a fund manager. Frank is a long-time friend of ours, and we've chosen to share his article originally published March 27, 2023. For more articles like this from Frank and other leading experts, you can subscribe to the U.S. Global Investors newsletter here.

Hard Stuff

Petrodollar Dusk, Petroyuan Dawn: What Investors Need To Know

By Frank Holmes

While most investors were trying to gauge the Federal Reserve’s next moves in light of recent bank failures last week, something interesting happened in Moscow.

During a three-day state visit, Chinese President Xi Jinping held friendly talks with Russian President Vladimir Putin in a show of unity, as both countries increasingly seek to position themselves as leaders of what they call a “multipolar world order,” one that challenges U.S.-centric alliances and agreements.

Among those agreements is the petrodollar, which has been in place for over 50 years.

In case you’re wondering, “petrodollars” are not a real currency. They’re simply dollars being used to trade oil. Early in the 1970s, the U.S. government provided economic aid to Saudi Arabia, its chief oil-producing rival, in exchange for assurances that Riyadh would price its crude exports exclusively in the U.S. dollar. In 1975, other members of the Organization of Petroleum Exporting Countries (OPEC) followed suit, and the petrodollar was born.

This had the immediate effect of strengthening the U.S. dollar. Since countries around the world had to have dollars on hand in order to buy oil (and other key commodities such as gold, also priced in dollars), the greenback became the world’s reserve currency, a status formerly enjoyed by the British pound, French franc and Dutch guilder.

All things must come to an end, however. We may be witnessing the end of the petrodollar as more and more countries, including China and Russia, are agreeing to make settlements in currencies other than the U.S. dollar. This could have wide-ranging implications on not just a macro scale but also investment portfolios.

Dawn For The Petroyuan?

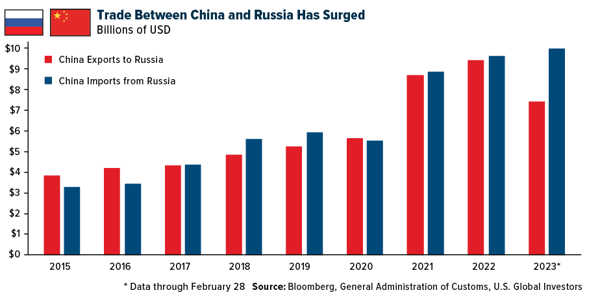

Putin couldn’t have been more explicit. During Xi’s state visit, he named the Chinese yuan as his favored currency to conduct trade in. Ever since Western sanctions were levied on the Eastern European country for its invasion of Ukraine early last year, Russia has increasingly depended on its southern neighbor to buy the oil other countries won’t touch.

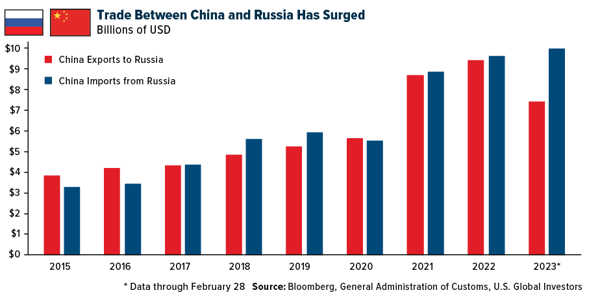

In just the first two months of 2023, China’s imports from Russia totaled $9.3 billion, exceeding full-year 2022 imports in dollar terms. In February alone, China imported over 2 million barrels of Russian crude, a new record high.

Except that now, the yuan is presumably being used to make these settlements.

As Zoltar Pozsar, New York-based economist and investment research director at Credit Suisse, put it recently: “That’s dusk for the petrodollar… and dawn for the petroyuan.”

U.S. Dollar Still The World’s Reserve Currency, But Its Dominance Is Slipping

Before you dismiss Pozsar’s comment as an exaggeration, consider that other major OPEC nations and BRICS members (Brazil, Russia, India, China and South Africa) are either accepting yuan already or strongly considering it. Russia, Iran and Venezuela account for about 40% of the world’s proven oilfields, and the three sell their oil in exchange for yuan. Turkey, Argentina, Indonesia and heavyweight oil producer Saudi Arabia have all applied for admittance into BRICS, while Egypt became a new member this week.

What this suggests is that the yuan’s role as a reserve currency will continue to strengthen, signifying a broader shift in the global power balance and potentially giving China a bigger hand with which to shape economic policies that affect us all.

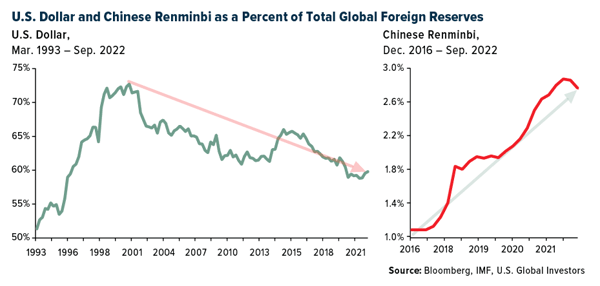

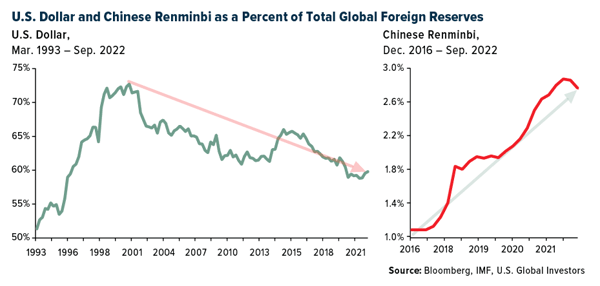

To be clear, the U.S. dollar remains the world’s top reserve currency for now, though its share of global central banks’ official holdings has slipped in the past 20 years, from 72% in 2001 to just under 60% today. By contrast, the yuan’s share of official holdings has more than doubled since 2016. The Chinese currency accounted for about 2.8% of reserves as of September 2022.

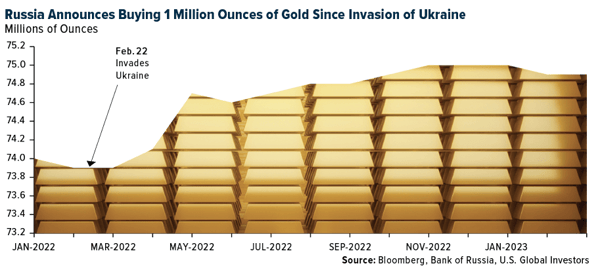

Russia Diversifying Away From The Dollar By Loading Up On Gold

It’s not all about the yuan, of course. Gold has also increased as a foreign reserve, especially among emerging economies that seek to diversify away from the dollar.

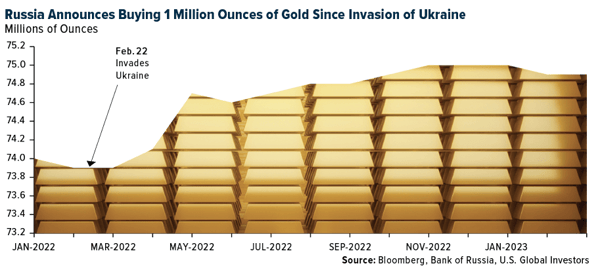

Last week, Russia announced that its bullion holdings jumped by approximately 1 million ounces over the past 12 months as its central bank loaded up on gold in the face of Western sanctions. The bank reported having nearly 75 million ounces at the end of February 2023, up from about 74 million a year earlier.

Long-Term Implications For Investors

The implications of the dollar potentially losing its status as the global reserve are numerous. Obviously, there may be currency risks, and a decrease in demand for U.S. Treasury bonds could result in rising interest rates. I would expect to see massive swings in commodity prices, especially oil prices, which could be an opportunity if you can stomach the volatility.

Gold would look exceptionally attractive, I think. A significant decrease in the relative value of the dollar would be supportive of the gold price, and I would be surprised not to see new highs. It’s for reasons like these that I always recommend a 10% weighting in gold, with 5% in physical bullion and the other 5% in high-quality gold mining equities. Be sure to rebalance at least on an annual basis.

|

__86459.jpg?height=200&name=SILVER-Bar-10oz-ASAHI(5)__86459.jpg)