|

Perspective

By Rich Checkan

It’s good to be back home.

I just returned from speaking and exhibiting at two conferences in less than three weeks. I was in Memphis for Mark Skousen’s FreedomFest a couple of weeks ago. Then, after a few short days in the office, I was in Boca Raton, Florida for Rick Rule’s Natural Resource Investment Symposium.

While I prefer to be home with family, I truly enjoy getting out to meet you several times a year. I relish our face-to-face conversations, and I always gain some insights into what is on your minds as investors.

In addition, I get to see what’s going on in the economy in different parts of the country.

The Gap Is Widening

After returning from Boca Raton, it is clear to me that the gap between the haves and the have-nots in this country is widening.

As one speaker joked from the podium last week, and I paraphrase, “Despite all the talk of recession of late, it is very clear there is no recession here in Boca Raton.”

Let’s face it, the average American cannot afford the Boca lifestyle on a regular basis. Few are even capable of escaping to it for a short vacation.

The reality for middle class Americans is much more dire.

They are feeling the sting of inflation. The job situation is less rosy than the numbers might suggest. Consumer debt is rising to alarming levels. Many households are one financial shock away from distress.

Let’s start with inflation. The numbers are cooling. Inflation has steadily drifted downward throughout the year. But it is still high inflation!

Prices today aren’t rising as fast as they were last year or earlier this year. But prices are still rising. Virtually everything costs more today than it did a year ago. The standard of living is dropping. Make no mistake about that.

Let’s look at employment numbers. The headlines suggest virtually everyone is working. However, the numbers don’t talk to the fact that people are taking lesser jobs… either less hours or lower wages… than what they had pre-pandemic. As a result, many workers need to work multiple jobs to cover their expenses. That gives the appearance more people are working when, in fact, they are not. And of course, many workers have simply dropped off the rolls altogether, so they are no longer counted.

And last but not least, consumer debt is entrenched above a trillion dollars.

This is concerning to me.

A few years back, when interest rates were at or near zero, homeowners could tap into their home equity to pay down debt to finance their consumption. Homes were the ultimate ATM’s or automated teller machines.

Now, all that has changed. With the Federal reserve’s aggressive interest rate increases, homeowners cannot afford to cash out the equity on their homes – especially considering home prices will most likely fall in value going forward.

Consumers, instead, are turning to credit cards to buy necessities such as food, fuel, and clothes. That is not a scenario that ends well.

Put it all together, and you have a middle class that is financially strapped with no relief in sight.

Fiscal Foolishness

Unfortunately, the problems will most likely get worse before they get better.

Fitch Ratings just downgraded U.S. long-term debt from AAA to AA+. Regular readers know exactly why, but here’s what Fitch said in a statement…

“The repeated debt-limit political standoffs and last-minute resolutions have eroded confidence in fiscal management. In addition, the government lacks a medium-term fiscal framework, unlike most peers, and has a complex budgeting process. These factors, along with several economic shocks as well as tax cuts and new spending initiatives, have contributed to successive debt increases over the last decade. Additionally, there has been only limited progress in tackling medium-term challenges related to rising social security and Medicare costs due to an aging population.”

We’ve talked about this often. Chairman Jerome Powell and the Federal Reserve can never solve our fiscal problems until Congress grows up and becomes responsible.

Revenue is down, yet Congress still does not know how to say “No” to new deficit spending. As a result, the Federal Reserve is left with no real choice but to expand the money supply. In a word… inflation.

This is a tax on every U.S. citizen resulting from Congresses lack of leadership and complete and utter fiscal irresponsibility. And the drop in ratings means higher debt servicing costs, increases to our debt, and even more inflation to come.

Lift-off Is Coming

In the meantime, gold and silver have largely held in range below $2,000 and $25 per ounce, respectively. This has provided investors with an extended buying opportunity… but don’t expect it to last forever.

It is clear to even the casual observer that the Federal Reserve is either done or very nearly done raising interest rates. They cannot go much further and still be able to service our $32 trillion debt.

The pause will come soon. The pivot – the lowering of interest rates – will follow. When that happens, we will have lift-off on gold and silver prices.

And since a pause may be enough to ignite the lift-off, we may see that as early as this fall.

The set-up is good as we transition from the summer doldrums to the active fall markets for gold and silver. Add a pinch of Federal Reserve inaction, and you will have wished you already had purchased your gold and silver.

Call us at 800-831-0007 or send us an email today so we can help you get your precious metals allocation in order.

And one final thought…

Be sure to mark 7PM EST Wednesday, August 16th on your calendar. That is when Adrian Day and I will welcome our special guest and long-time friend, Alex Green to our 3rd Quarter On the Move webinar.

Alex has been wildly successful as Chief Investment Strategist of The Oxford Club, and he brings an optimism to the table that is sorely lacking these days. I for one am anxiously looking forward to our discussion, and you can join us live by simply registering below.

See you then…

—Rich Checkan

Editor's Note: Alexander Green is Chief Investment Strategist of The Oxford Club. On August 16th, he'll be joining us for the next On the Move webinar... register today! This article was originally published in Liberty Through Wealth on June 26, 2023.

Feature

If We Have It So Good, Why Do We Feel So Bad?

By Alex Green

In Friday's column, I noted my shock that a majority of Americans polled believe that life was better 50 years ago.

Why am I surprised?

Because by almost every objective measure, there has never been a better time in history to be alive.

The human life span has nearly doubled in the last hundred years.

Formal discrimination against women and minorities has ended.

Standards of living have never been higher. (U.S. poverty recently hit a record low. Median household income and net worth are near record highs.)

Senior citizens are cared for financially and medically, ending the fear of impoverished old age.

Educational attainment has never been greater.

Technology and medicine are saving, extending and revolutionizing our lives.

Travel - to the next town or the other side of the world - has never been easier or more affordable.

Despite a recent spike in violence, crime is in a long-term cycle of decline.

And - while we have rarely been more polarized politically - the country is at peace.

In the West today, we have tremendous economic and political freedoms.

We work shorter hours, have more purchasing power, enjoy goods and services in almost limitless supply, and have more leisure time than ever before.

I'm not trying to idealize our lives or argue that we live in a perfect world. Far from it.

But the trend is clear: Human well-being is in a decidedly upward arc.

Yet - for decades now - Americans have routinely told pollsters that the country is going downhill, their parents had it better and their children face a declining future.

When I cite facts to the contrary, readers often ask, "If things are so good, why do we feel so bad?"

I believe there are seven primary reasons:

- Lack of perspective. Few truly realize just how tough life was for our ancestors. Over 98% of human history was preagricultural. We hunted and scavenged to survive. Most people were dead by the age of 25, usually of unnatural causes. Even with the advent of agriculture, people performed backbreaking work for a subsistence living. Beginning in the 19th century, the Industrial Revolution improved our lives. But most folks still worked long hours doing tough physical labor. Your great-grandparents would view your life today - with all its modern conveniences - as the realization of some utopia.

- Media negativity. Turn on cable news now or pick up a paper and you'll quickly conclude that the world is going to hell in a handbasket. You hear about war not peace, corruption not honesty, short-term setbacks not long-term advances. According to one study, over 90% of the articles in The Washington Post have a negative slant. Each day's news is a highly nonrandom sample of the worst things happening around the world. The media knows that sensationalism and negativity sell. As a result, they deliver the world through a dark prism. And most people buy into it.

- Habituation. Whenever revolutionary new products or developments appear, we rapidly adopt them and they become ho-hum. Heart transplants, space probes, high-speed internet connections, smartphones, 5G, 70-inch Ultra HD screens, 3D printing, artificial intelligence... so what else is new? Here's a dose of reality: Try navigating your way to the Kennedy Center from the Capital Beltway, in heavy traffic, at night, in the rain... without a GPS.

- The hedonic treadmill. In some ways, we are hardwired to feel dissatisfaction. Psychologists call it the hedonic treadmill. We strive to achieve what we desire. Those things satisfy us for a while. But nothing ever quite does it for us. So we yearn for something more: a better-paying job, a new car, a bigger house, a firmer abdomen, a sexier spouse. It's a recipe for unhappiness - and the antidote is gratitude.

- Status anxiety. Scientists have found that, to an astonishing degree, our satisfaction with life is tied to positional rankings relative to others. This denies us the contentment we deserve and is an insult to ourselves. Worse, it's entirely self-imposed. Honoré de Balzac called envy "the most stupid of vices, for there is no single advantage to be gained from it."

- Apprehension about the future. Despite widespread prosperity, people often remain convinced it cannot be enjoyed because of the coming (take your pick) economic meltdown, political crisis, terrorist attack, population explosion, bird flu epidemic, mineral shortage, debt default, environmental catastrophe, nuclear accident, global pandemic, climate emergency or rogue supercomputer. I'll be the first to concede that future peace and prosperity are not guaranteed. But there are two things to keep in mind. The first is that alarmists of all stripes have been telling us to cup our groins and crawl into the fetal position for two centuries now, and things really haven't gone their way. Today, reason, technology and free markets operate as an enormous problem-solving machine, improving our lives in almost every way imaginable. Could things go off the rails at some point in the future? It's possible, of course - and a good reason to enjoy what you have now. After all, we're only here for a visit.

- Lack of community. Years ago - before the triumph of streaming and social media - people entertained themselves with dances, dinner parties, social meetings and competitions. That is the exception today. Americans spend an average of more than seven hours a day in front of screens connected to the internet. Yes, part of this is work related. But Facebook, Snapchat, Instagram and Twitter provide only a superficial connection with other people. Real conversations are awash in facial expressions, tones of voice, body language and other nonverbal cues. There's a big difference between pushing a "like" button and seeing people laugh and smile.

Looking at this list, you might be tempted to upgrade your perspective, pay less attention to the media, step off the hedonic treadmill, appreciate what you have, quit comparing yourself to the Joneses, log off your laptop, and spend more time in the here and now.

And I wouldn't disagree.

Our country has always faced serious problems and we always will.

Moreover, many readers are struggling with personal issues - work problems, family problems, health problems or financial problems - just like all people in all places and times.

But we're grappling with these problems during the most favorable milieu in human history to be alive.

It makes sense to stop and appreciate that.

This is particularly true for investors. After all, if Western civilization really is in imminent peril, why would you risk your hard-earned money in the stock market?

You wouldn't.

Fortunately, life isn't just one damn thing after another. It's getting better for most people in most places in most ways.

Which is not the same thing as everything getting better for everybody in every way.

That would be a miracle... not progress.

People in the West today are living longer, healthier, safer, richer, freer lives than any people in the history of the world.

That's something to celebrate.

Editor's Note: Brett Eversole is the lead editor and analyst for True Wealth, True Wealth Systems, True Wealth Real Estate, and DailyWealth. This article was originally published in DailyWealth on August 1, 2023.

Hard Stuff

Rate Hikes Might Finally Be Over for Good

By Brett Eversole

We can finally put the worries of runaway inflation to bed...

The most recent Consumer Price Index data came out last month. It showed that the overall inflation rate had dropped to just 3%. That's down from 9.1% at the peak last June.

That incredible decline is great news for all Americans. It means the painful price increases on our consumer goods are slowing down... And for investors, it's also quite the gift, as stocks have been rallying on the news.

Still, in an outrageous move, the Federal Reserve hiked interest rates again last week. But based on logic – and the market's reaction – those rate hikes are nearly finished, too. And that's a massive win for stocks.

Let me explain...

It all started with the Federal Reserve's aggressive plan to kill inflation back in March 2022.

The initial thought was that interest rates would need to rise above the inflation rate to get inflation under control. So, the Fed has pushed the target federal-funds rate to 5.25% in one of the fastest rate-hike cycles in history.

Interest rates are well above the inflation rate today... which means the Fed's job should be over, right?

That's what you'd expect. But apparently, the Fed never got the memo...

Last week, the Fed announced that it would take us to 5.25% with another 25-basis-point rate hike. It made that decision despite choosing to pause in its previous meeting.

Now, let me be clear... This is absolutely crazy.

The Fed's call to keep hiking rates is borderline negligent. The central bank has already achieved its goal. Inflation is down, and the economy has clearly cooled versus where it was two years ago.

Regardless, higher rates can't last much longer... because the money supply is already tight enough. Heck, it's tighter than almost anyone realizes right now.

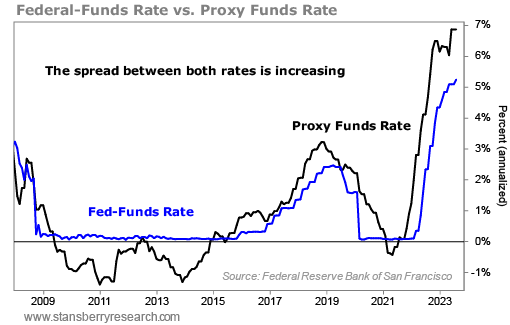

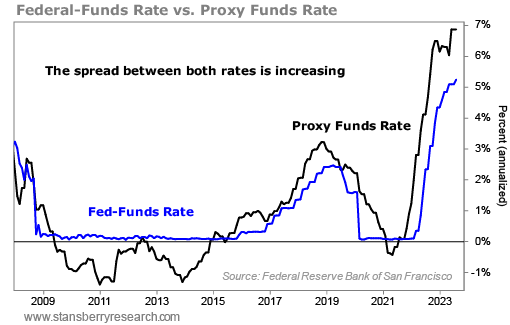

We can see that through the "Proxy Funds Rate" from the Federal Reserve Bank of San Francisco. This indicator takes the normal federal-funds rate and adjusts it for greater accuracy based on what the Fed is doing with its balance sheet.

Lately, the central bank has been shrinking its balance sheet. And that's tightening the money supply. Right now, the Proxy Funds Rate is a staggering 6.9% – well above the reported fed-funds rate. Take a look...

This chart shows that the money supply is much tighter today than the 5.25% fed-funds rate would indicate. And given the massive decline in inflation, it's one more reason to believe that rate hikes are darn close to ending, if not already done for good.

Of course, nothing is certain. But the Fed has done its job. And soon, it should realize this fact and stop clamping down on the economy.

If you look at the stock market, it seems like most investors expect the Fed to ease its approach. Stocks are up since the Fed hiked rates last week.

We're also darn close to new all-time highs. The S&P 500 Index only needs to rise another 5% to get there... And with rate hikes coming to an end, I expect we'll hit that milestone sometime this year.

The Inside Story

The Truth About Collectibles

By Madeleine Coe

A recent Washington Post article shone a light on unscrupulous practices within the precious metals industry.

“Unlike most bullion coins, however, [these] coins are typically exclusive to the companies who sell them, usually with markups far higher than those charged by mainstream coin retailers,” the article revealed about how these scammers take advantage of unsuspecting clients who assume that because these companies are able to advertise on major news networks that they can be trusted.

This is unfortunately not the case.

In case you’ve ever considered buying from these bad actors, remember that the margin on precious metal bullion is normally extremely tight, so for these companies to have the massive advertising budgets required to be able to advertise on television, there is no way they are charging close to what reputable dealers do.

Even worse, many of these untrustworthy dealers tout coins as “modern numismatics”, developing limited edition designs, promising that they will hold future collectible value.

But, limited edition does not equal rare. And rareness in availability does not mean they will ever have collectible value.

There is a difference between bullion, numismatic coins, and other dubious gold products on the market, and it’s important to know the difference.

Should I Invest in Numismatics?

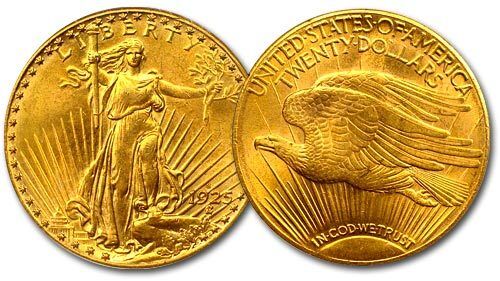

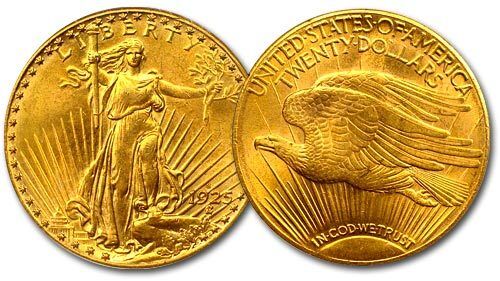

Owning real numismatic coins with precious metal content is a savvy way to turn coin collecting from a hobby to an investment strategy. Coin collecting can be a profitable venture when done the right way, and numismatics make a great alternative asset for those looking to diversify their portfolio. Rare coins, in particular pre-1933 U.S. gold, make for prizeworthy pieces in a collection and an investment with potential for growth.

Rare U.S. coins are a commodity like few others, and there is a limited supply available. Rare coin prices are determined by what is sold around the world and rises as investors and collectors pay more for these increasingly rare items.

As a long-term investment, rare U.S. gold coins are a good next step after achieving the benefits of portability, privacy, market performance and currency protection with precious metals in bullion form. Rare coins are an asset class not correlated to other mainstream, traditional assets and therefore largely unaffected by volatility and downturns in other markets.

Certified Coin Grading

If investing in coins purely for their numismatic value, it’s important to deal in certified coins only. It can be difficult to determine the value of a coin purchased from an eBay auction, whereas certified coins guarantee a certain level of quality and will be easier to resell. Certified coins are those which have been inspected and graded by a recognized organization such as the Numismatic Guaranty Company (NGC) or the Professional Coin Grading Service (PCGS), then placed in a protective holder, known as a slab.

With certified coins, it is important to understand what is meant by a coin’s grade. Based on condition, coins can be graded from Poor, at the lowest end of the spectrum, all the way up to rare and pristine Gem Uncirculated. In addition, many appraisers use the internationally accepted Sheldon grading scale of 1 to 70, which was first used in the United States in the late 1940’s. The higher the number, the better the grade of the coin, and the more it will be worth at auction or on the open market.

The Truth About Collectibles

But a certified grade still doesn’t necessarily indicate that a coin will have future collectible value on the open market.

Pre-1933 U.S gold coins occupy a desirability and rarity beyond their melt value because of unique circumstance. President Franklin Delano Roosevelt issued Executive Order 6102 in 1933, and as a result, millions of previously circulated gold coinage was confiscated and melted down. The coins that have been recovered from the previous era are ones that remained hidden or were stored out of jurisdiction in vaults overseas. The coins left from this time are truly the last of their kind, mere percentages of the original mintages remain, and even fewer in quality condition because of the wear and tear.

Unless a similar act were to occur in the future (and this is so extremely unlikely to happen due to the U.S. dollar no longer being on the gold standard… there would be absolutely no reason for it), there is no reason to believe that the scarcity of these modern issue collectible coins will ever result in desirability.

The truth is that the high mark-ups on modern issue collectible coins are based on a false perception, and they have no more collectible value than any other souvenir or trinket, their only worth is in their melt value.

Even the special proof edition coins released by reputable mints are not a guarantee of collectible value. Every year the U.S. Mint releases slabbed Certified Proof American Eagle coins, but the reality is they have no additional value than their standard issue bullion counterparts. 1 oz. of gold will always be worth 1 oz. of gold, unless extraordinary circumstances occur… that combination that resulted in the vibrant U.S. pre-1933 gold market of true rarity and desirability simply cannot be manufactured.

Shop Around Shop Around

The best advice that I can impart when it comes to buying bullion and collectible coins is this… if it sounds too good to be true, it is.

A collectible coin or bullion coin’s price should easily be comparable with research. Before you buy anything, compare premiums with the same coin at multiple dealers. If it’s out of range, the price cannot be justified. If there’s no secondary market for that item, it does not justify the premium.

Moreover, look for transparency with the dealers you buy from so you can determine if they are worthy of your trust.

But don’t let your concerns keep you from adding a sound allocation of precious metals to your portfolio. We expect precious metals prices to continue to increase over potentially the next 5-7 years.

In that time, we also expect an increase in cases of would-be investors falling prey to scams. Don’t let yourself become a victim.

Asset Strategies International has been in business for over 40 years with zero complaints. ASI’s mission that you “Keep What’s Yours” is why our representatives don’t work on a commission basis… they are here to serve you. Give us a call at 1-800-831-0007 to discuss your options on precious metals products that can be trusted to help you preserve your wealth.

|

Shop Around

Shop Around