|

Perspective

By Rich Checkan

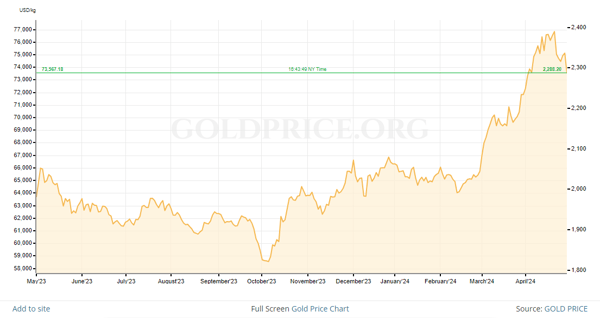

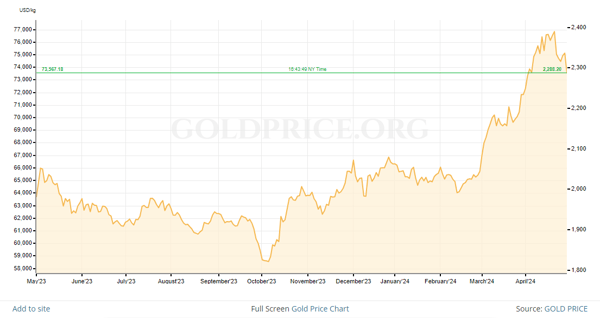

After moving up $600 per ounce in less than two months, gold finally took a little bit of a breather last week.

Of course, that prompted many to ask, “Is that it? Is gold’s bull market over?”

Nothing could be further from the truth.

We saw some profit-taking from speculators. We saw some “tired liquidation” from long-term holders of gold who simply felt they had waited long enough for a higher gold price… and they were not going to wait any longer.

And we continued to see a handful of people selling a small portion of gold or silver to pay down credit card debt.

None of those selling activities are indicative of the end of a bull market. They are very much indicative of a short-term correction in a larger bull market.

Embrace these opportunities to add to your allocation. These are fantastic prices to buy well… before the next leg up.

Keep What’s Yours!

If you have followed Asset Strategies International over the years, you know this is our mantra. If you are reading us for the first time, you know it now.

Oftentimes, we take it for granted that people know what those three words mean. But they are too important to leave their understanding up to chance.

So, I would like to share an excerpt of a recent email exchange I had with one of our most valuable, loved, and respected business associates in response to last month’s Perspective article and reported performance of gold. In his reply, this former bank chairman captured the essence of why we buy and hold gold… and why we have made it our life’s work to help others do the same…

“Thank you, Rich, looks very good. On the one hand, the total performance looks fantastic.

On the other hand, the unfortunate truth is, that most of this increase in value (on a figure basis) does not really buy you more than before – meaning, the goods with a higher price tag in general are not more expensive, but the money lost value, is worth less and buys less.

So, to a great extent you have preserved with gold just your purchasing power. The higher price of gold stands up against higher prices for other goods which you might need to buy.

Inflation is man made by the government by increasing money supply (not necessarily by printing but through higher borrowing and creating excess liquidity which does not meet higher productivity and output). In this way people get scalped without realizing it (or not knowing what is happening to them).

It is eventually a more painless feeling for them to help to repay government indebtedness indirectly rather than to see taxes eating up your income.

The tragedy is we have both inflation and increases in taxes, and therefore really are becoming poorer every day if you do not counteract, i.e., to work and create higher income and to hold your savings in tangible assets (which need to have a good and liquid market).

Now, what is the conclusion: gold is still the commodity which in such an environment is king. In the longer run it helps you to maintain you purchasing power and to buy the same amount of stuff you did not need to buy earlier.”

When we encourage you to Keep What’s Yours, this is what we are talking about. Sometimes, hearing it in a different voice – in this case, from a European perspective – helps the message hit home.

I hope that is the case here, because we expect some challenging times ahead. Without gold, they may be catastrophic. With gold, you should be just fine.

Something’s Brewing

Last year, we saw five FDIC-insured banks fail… Silicon Valley Bank (March), Signature Bank (March), First Republic Bank (May), Heartland Tri-State Bank (July), and Citizens Bank (November). The assets of those five institutions totaled approximately $550 billion.

Despite the fact that one bank failed in each of the third and fourth quarters, most everyone considered the banking crisis of 2023 contained following the collapse of First Republic on May 1st of last year.

Despite the fact that the Federal Reserve has destroyed the balance sheets of virtually every U.S. bank by aggressively raising interest rates and driving the bank bond portfolios down to levels of insolvency, most investors still believe the bank crisis has been contained.

Despite the fact that New York Community Bank continues to struggle as a result of high interest rates and low commercial property values, most people believe the banking crisis is behind us.

Despite the fact that Republic First Bank of Philadelphia was seized by regulators this past weekend due to the same issues that plagued the five failed banks from 2023, mainstream news is reporting that Republic First’s issues are not a sign of a broader banking crisis.

Excuse me?

Are they serious?

Of course, this is just one issue. There are a few other matters out there which should be cause for investor concern…

- Debt… government, corporate, and individual

- Unfunded entitlement liabilities… Medicare, Medicaid, and Social Security

- Political dysfunction

- U.S. dollar alternatives… potential loss of reserve currency status

- Failing financial might… leading to…

- Failing military might… amidst the real possibility of a two-front war

Gold is Dirt Cheap. Silver Is Cheaper.

You have heard me say this repeatedly over the past couple of years. You will hear me say it much more going forward as well.

At all-time highs, gold is dirt cheap. At half of all-time highs, silver is even cheaper.

If you have not taken care of your allocation to gold and silver with all these potential threats to your wealth lurking on the horizon, I cannot comprehend why.

Now is the time to ensure you are properly allocated with wealth insurance. And now, right after a short-term pullback in a clear and emerging bull market, is the time to buy both gold and silver well.

There is no better way I know to Keep What’s Yours!

Buy on our website directly… www.assetstrategies.com. Call us at 800-831-0007. Or, send us an email.

…AND… be sure to tune in next Tuesday, May 7th, at 7PM Eastern Time for the next installment of On the Move. Adrian Day and I will be talking with Peter Cavelti. You do not want to miss this. Register here.

Until then…

—Rich Checkan

Editor's Note: Peter Cavelti was born and educated in Switzerland. His background as an investment professional spans more than 50 years and four continents. Subscribe to his Strategic Updates newsletter for free at cavelti.com or send them an e-mail at calconsult@cavelti.com. He will also be the special guest at the next On the Move Webinar. Register here to hear his insights live on May 7th.

Feature

Eye of the Storm?

By Peter Cavelti

Not too many days ago, predictions of World War III prevailed, as Israel threatened harsh retribution for Iran’s drone and missile attack. Then the U.S., Britain and France publicly discouraged Netanyahu’s government from such a course. So, at least for the moment, rhetoric and action have cooled off. Optimists feel that we’ve entered a moment, or even a period, of calm; pessimists are convinced that the current pause is the proverbial calm before the storm.

For the United States, the Hamas attack of October 7 and Israel’s massive retaliation in Gaza, came at a bad time. Already deeply involved in Ukraine (a war that’s not going the West’s way at all), and intent on expanding its engagement in Taiwan, the last thing a strategically overextended America needs is an all-out regional war in the Middle East.

What would such a war be like? The odds are high that traditional U.S. alignments, like the ones with Saudi Arabia, the Emirates, Egypt and other Arab nations would be challenged or even end. Not a good outcome for America, nor for Israel. Also, given the importance of the Strait of Hormuz, any further escalation with Iran would send oil prices soaring, aggravating inflation patterns and further straining U.S. fiscal challenges—all in an election year.

U.S. Economic Leadership

On the economic front, too, Washington’s policies are unravelling at a rapid pace. While the American “can-do” attitude is universally admired, consecutive governments have steadily undermined entrepreneurship. Instead of stoking the engines of economic well-being, namely small and medium-sized business, Washington has enabled the emergence of massive monopolies and the concurrent shrinking of a once weighty middle class. The biggest problem is that control of the U.S. government by the monopolists is nearly impossible to reverse, especially given a system where campaign finance contributions are virtually unlimited and there are no term limits for legislators.

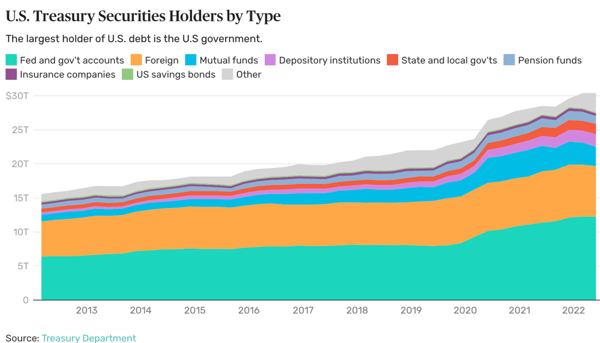

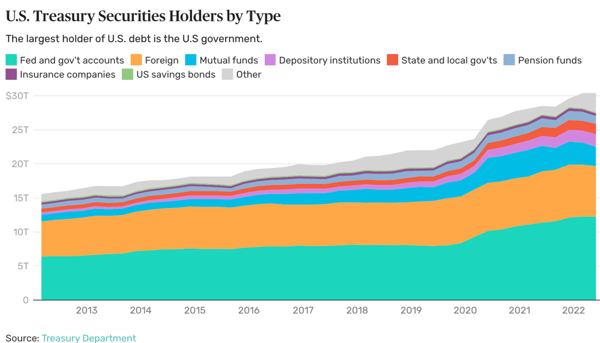

Another huge negative is America’s indebtedness at all levels. To be sure, other national economies have similar debt loads (at least at the government level), but their debt is mostly owned domestically. In sharp contrast, more than $7 trillion of the U.S. national debt (the orange part of the chart below) is held by foreigners—more than what is held by the country’s depository institutions, mutual and pension funds and insurance companies combined.

In the past many decades that was made possible due to the dollar’s role as the world’s reserve currency, but the future may look different. A growing number of countries have cut back their holdings of U.S. debt securities and their use of the dollar—some out of concern with America’s reckless spending habits, while others are worried about Washington’s growing use of financial sanctions. And as they contemplate dollar alternatives, the member nations of the BRIC’s block and the Shanghai Cooperation Council (which now represent the largest part of the world by several metrics) are busy discussing the launch of a currency of their own.

The two questions that are being asked by investors around the world:

-How much further can America push its unsustainable economic, social and military platforms before those financing them lose faith?

-Will America’s demise as the world’s hegemon play out soon and suddenly, or over a period of many years?

No one knows, but this doesn’t mean that financial markets won’t anticipate all kinds of scenarios, some of which will never manifest. But that won’t take away from the underlying problem: the U.S. and some of its key allies are in serious trouble and their governments have no good choices left.

If our politicians continue to maintain that all is well while undeniably reckless policies are left in place, inflation will reaccelerate, and so will the decline in the standard of living. And if they take remedial action, the economy and the social fabric will experience different, but equally painful shocks.

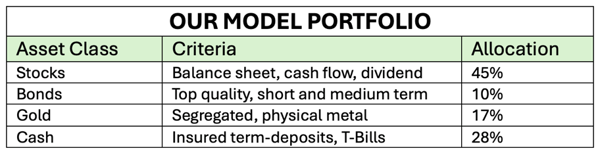

Either way, the odds are high that our investments will be affected with increasing frequency and intensity. Under such circumstances, conventional buy-and-hold strategies make little sense. Your portfolio holdings should have a high degree of liquidity, feature strong balance sheets and have proven and sustainable business models. Importantly, there is no room for dogmatic thinking in today’s environment—be completely prepared to accept that your assumptions were wrong and adjust your portfolio accordingly. There are many imaginable scenarios in which no one wins, but pragmatism is by far the best strategy. In short: be defensive, nimble and flexible!

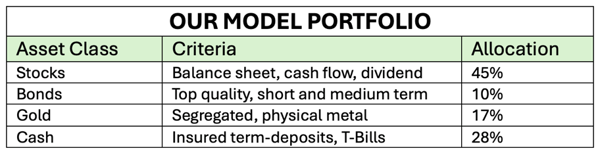

Portfolio Update

So far, 2024 has been a great year for us. Being selective within the stock market, very cautious about bonds and committed to our robust gold position was exactly the right formula.

The question, of course, is what will happen next?

Let’s deal with equities first. The upward trend in the S&P500 that started last fall is being challenged, but whether this is the start of a meaningful correction is far from certain. We’ve avoided sectors that are overbought and overvalued (notably tech) and stuck to more defensive and undervalued areas. As I said above, sound balance sheets are a major plus in this environment, as is sustainable strong cash flow. Throughout the past months, we’ve built positions in commodity stocks, from energy to base metals such as copper, silver and uranium.

Bonds remain in no-man’s land. As you know from our previous updates, we’ve never bought into the widely held notion of an interest rate “pivot”. We’ve also been extremely skeptical of the government’s inflation assessments, and evidently we are not alone. The only people who actually believe that U.S. inflation is at 3.5% are those far removed from the challenges “ordinary people” face in their daily life.

One thing to keep an eye on is the behavior of foreign buyers of U.S. Treasury debt. So far, demand has held up, mainly because U.S. interest rates are highly competitive, which in turn has kept the dollar strong. Of course, that may change if the Fed submits to political pre-election pressures and materially lowers rates. That’s yet another reason we remain cautious on bonds.

As anticipated, gold reached new highs. What is truly noteworthy is that the yellow metal keeps gaining in the face of a strong U.S. dollar and in an environment of relatively muted North American demand. So, to the question of the day: where is the demand coming from and what is motivating the buyers?

Let me answer the second question first. I believe the quickly deteriorating geopolitical environment, a lack of faith in the sustainability of the dollar’s current strength, and the rapid deterioration of America’s fiscal household are all key reasons. I suspect last weekend’s passage of the REPO Act, which paves the way for the Biden administration to confiscate billions more in Russian sovereign assets that sit in US banks, will provide additional motivation to exit dollar positions and buy bullion.

Who are the buyers of gold? The easy answer is foreign central banks, but statistics on CB purchases don’t explain the totality of recent demand. I believe high net-worth individuals in places like China, the United Arab Emirates and elsewhere are also aggressively buying. In time, investors in the U.S. and Europe will join the fray, which should help the gold price further.

For now, the yellow metal is in profit-taking mode; after all, the geopolitical environment has entered a moment of calm. I expect support at around US$2,285, after which the bull market should resume. Yet, no matter what exactly gold’s short-term movements will turn out to be, I see no reason to part from the 15% position we’ve been holding for the past five years.

Cash Matters. Whenever I talk to investment managers, I am stunned by their entrenched view that cash should be avoided. On many occasions I’ve been told, “Wait a minute—cash is not an asset class.” I completely disagree. There have been several periods during my 50+ year career when the inclusion of a substantial cash hoard invested in T-bills or term-deposits provided both decent returns and portfolio protection. For now, based on my belief that the economy is weakening and that financial markets are overextended, one-year rates of 5.5% on U.S. Certificates of Deposit or 5.25% on Canadian Guaranteed Investment Certificates seem highly attractive.

Editor's Note: Adrian Day is president of his eponymous money management firm, offering discretionary accounts in both global markets and resources. He also manages the Europac Gold Fund. To see if a managed account might be right for you, call ASI and we'll make the connection. Call 1-800-831-0007 for more information.

Hard Stuff

It's Only Just Begun

By Adrian Day

The gold price has surged over the past 18 months; it was just over $1,600 in the last months of 2022. But this surge has little to do with wars in the Ukraine and Middle East. With interest rates, until recently, moving up and the dollar strong, nor was it a response to the typical environment in which gold would shine. To know who is buying is to understand why; and also to have some insight as to the direction the price may go in the months and years ahead. Traditional Western buying has been of little help so far.

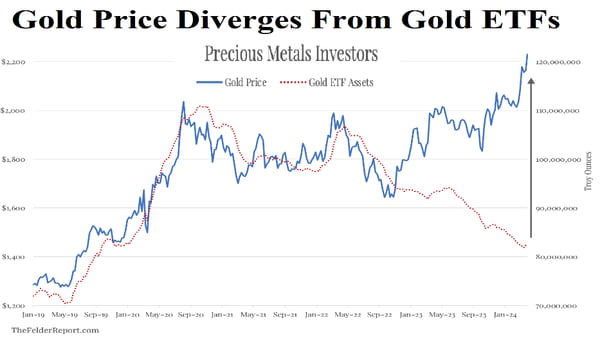

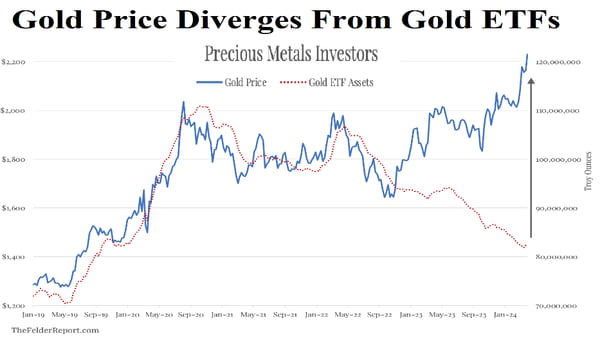

As is well known, last year, it was largely central bank buying that drove the price of gold, while ETF flows and other indications or demand remained negative. Central banks buy physical gold; they do not buy silver and they certainly do not buy gold stocks.

Central Banks and Chinese Buy; Westerners Continue to Sell

This same pattern continued into this year. Reports of central bank buying tend to lag, but we know that they remained heavy buyers in January and February, with a diverse group of countries buying, including China, the Czech Republic, Kazakhstan, Qatar, Turkey and Mauritania. Although buying has been strong, it does represent a slowing of the trend of the last two years, which were records for recent years. January saw a total of net buying of 45 metric tonnes, compared with 1037 tonnes in 2023. (There are no statistics yet on buying in March or April.)

Central banks were buyers primarily as a way to diversify out of the U.S. dollar, both for diversification reasons––foreign central banks still hold most of their foreign assets in dollars–-but also because of the weaponization of the dollar.

And at the same time, there was steady selling from gold ETFs for the first two months of this year.

Although central banks were the main drivers of gold prices, they were helped by growing private demand from China, both from speculators and savers. Last year, jewelry demand rose 10% while demand for bars and coins jumped 28%. This year, demand seems to be growing even more, as evidenced by numbers from the Shanghai Gold Exchange; from gold imports into Hong Kong (the traditional port of entry for gold); and evidence from jewelry stores. In the last two months, volumes on the Shanghai exchange are more than double what they were for the prior three months, while imports are up 78% this year.

Chinese savers are concerned about the state of the economy, with increased concerns about the prospect of a devaluation in the yuan looming. They want to protect their wealth, but the banks are not necessarily stable; traditional avenues for Chinese to store wealth like real estate and stocks are weak; while crypto is banned. Gold is the obvious remaining asset.

There has been, however, very little help from western investors, both institutions and retail. Not only did gold ETFs see steady selling for most of last year and into this, coin dealers in both North America and Europe were similarly reporting far more selling that buying; shipments from mints and coin premiums reflect this.

There Are Now Small Signs of Encouragement

Recently, however, there has been a shift in these patterns, perhaps not yet a reversal but something perceptible none the less. Since early March, there are been some days with net inflows into ETFs, after two solid months of relentless selling. In the past 10 days, only three days have seen net inflows. And even on good days, ETF buying remains modest. On the 22nd, the last day with net inflows, there was a total of less than 100,000 ounces added, which is less than the central banks have been buying every single day…and that was one of the best days this year for ETF inflows. Though flows for the year remain negative, any inflows are somewhat encouraging. Similarly, bullion and coin dealers are now reporting a pick-up in interest from people wanting to buy gold, though flows remain neutral at best.

In addition to central banks and Chinese consumers, however, there must have been another source of demand to counter ETF and retail selling from the West. We suspect wealthy families and institutions, primarily in the Middle East and Asia but also Europe, have been buying as an insurance asset to protect against financial instability. Gold’s strength in the face of factors that are usually headwinds––a strong dollar, high interest rates, a (seemingly) strong economy, buoyant equity markets––again suggests that it is not traditional investment demand.

The Strange Case of Equity Selling

From the end of 2022 until beginning of March this year, though the gold price surged, silver and precious metals equities were left in the dust; gold and silver stocks were actually down for the period. Given the economic environment and strong S&P, this was logical. Then something changed, with both silver and PM equities dramatically outperforming gold in the last two months. This performance goes along with the shift we have seen in ETF flows and other indicators.

Of course, though rates remain high and the dollar strong, the markets are looking ahead. Even though the Federal Reserve has been pushing back recently against expectations an imminent change in policy, the markets realize that sooner or later, there has to be an easing in monetary policy.

Even the Gold Stock ETFs Are Seeing Selling

Most gold mutual funds are reporting that inflows are neither consistent nor strong. Significantly and counter-intuitively, however, there have been strong outflows from the GDX, the largest by far of the precious metals equity ETFs. See chart. This is not a sign that retail investors are pouring back into gold stocks and responsible for the 30% move since the beginning of March. It would appear that it is a few large and sophisticated players buying the gold stocks. Or perhaps hedge funds are buying preferred individual names and hedging by selling the index.

However, this is a sign for great optimism. If gold can surge 50% in the course of 18 months, if silver can jump 20% and gold stocks 30% in two months, all while there are large outflows from ETFs, all in the face of a strong dollar (at six-month highs), and after the strongest move in interest rates at least since the end of the 1970s, then imagine what could happen when institutional and retail sentiment in the West turns broadly positive.

There is a long way to go. Gold, despite new nominal highs, remains well below its previous 1980 high on inflation-adjusted or money supply-adjusted bases, while the major mining stocks continue to trade very close to their multi-decade valuation lows. The size of the entire gold and silver equity market––a total market cap of about half a trillion dollars–-is tiny compared with the broad market; Microsoft alone is six times that. Right now, various reports show that global investors have less than 1% of their assets in gold––some calculations put it at least than 0.5%-–-compared with the longer-term historical average of 4%. When only some of the money from erstwhile market leaders shifts into hard assets and that average holdings move even part way back to the historical average, the moves in gold, silver, and precious metals equities will be explosive. The shift, as we have shown, has barely begun.

Editor's Note: Keith is Principal at the Fitz-Gerald Group which provides bespoke consulting to professional wealth managers and publishes the popular 5 with Fitz and One Bar Ahead® for individual investors. Visit www.keithfitz-gerald.com to learn more.

The Inside Story

Don't Speculate When You Actually Want to Invest

As we find ourselves about halfway through 2024, I thought it would be worthwhile to share a brief conversation with you. I recently spoke with Keith Fitz-Gerald, Principal at the Fitz-Gerald Group.

Keith’s insights into those markets for 2024 are absolutely worth the 15-minute listen. His three commonsense rules for investors may very well be the best guidelines you'll hear for investing successfully and building real wealth in this environment.

Click here to view.

|