The U.S. dollar weakened Monday amidst new uncertainty surrounding President Trump’s tariff...

Gold's Correction is a Chance, Not Setback

Gold fell over 2% yesterday as Iran and Israel backed off from the larger Israeli counterstrike that many feared would result in an escalation in conflict.

Expectations are also growing that the Federal Reserve will delay cutting interest rates. The prospect of high interest rates is typically bearish for gold, making it a less attractive alternate investment compared to assets like U.S. Treasury bonds and the dollar.

Despite the dip, the long-term outlook for gold is positive. In addition to geopolitical tensions and interest rate cut speculation, gold's trajectory in 2024 has also been buoyed by a strong bullion retail market in China, as well as central bank gold buying. And while U.S. interest rate cuts are delayed as inflation remains sticky, they will be cut at some point, at which gold will see a massive boost.

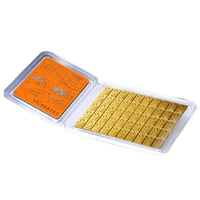

This current dip from all-time highs is an excellent opportunity to add gold to your portfolio, especially in the face of lingering inflation.

To that end, we're offering America's most popular bullion coin at a lower premium to help you take advantage of the current market situation. Don't miss out on the opportunity to obtain gold at lower spot prices before it surges again.

Give us a call at 1-800-831-0007 or email us to place your order today!

1 oz. American Gold Eagles

Just $99 over spot

PLUS a Free 1 oz. Silver Eagle for every 3 coins purchased!

*Prices subject to change based on market fluctuation and product availability. Prices reflected are for cash, check, or bank wire. Minimum order is 1 oz. gold. Free shipping, handling, and insurance are available for purchases of 10 oz. gold or more. Receive one free 1 oz. Silver American Eagle for every three 1 oz. gold coins purchased. Date selection is random and dealer's choice. Offer expires Friday, April 26, 2024, or while supplies last.