|

Perspective

By Rich Checkan

Two days ago, American voters turned out in large numbers to cast their votes for our next president. Vice President Kamala Harris was pitted against former President Donald Trump.

And the winner is?

Gold and silver.

Unlike four years ago, the presidential election was decided in one day. Last time, it took until Saturday to declare President Biden the winner.

From a standpoint of fiscal responsibility, the American public and the U.S. dollar lose yet again.

In over fifty years, the U.S. government’s budget has been balanced exactly twice. President Lyndon Johnson did so in 1969. President Bill Clinton did so from 1998 to 2001.

Make no mistake. Gold and those who hold it are the winners in this election cycle.

A Busy Week

Starting with last Friday, there have been (or will be) a number of market-moving events over the past week.

Last Friday, we saw a very disappointing jobs report. Only 12,000 new jobs were created. The market, however, was anticipating the creation of over 112,000 new jobs.

Of course, those numbers may have been negatively affected by the impact of hurricanes or by the impact of the Boeing strike. In the case of the hurricanes, we may be seeing less new jobs created or simply the inability to collect data on new job creation.

Either way, a 90% disappointment in new job creation is a bitter pill to swallow.

However, since the horrible jobs numbers may or may not be believed, that puts some stress on the interest rate decision the Federal Reserve is about to make during their two-day Federal Open Market Committee (FOMC) meeting this Wednesday and Thursday.

It is difficult enough – some might even say impossible - to make decisions about interest rates when all the data is accurate and clear. It becomes beyond impossible when you cannot trust the data you use to make the decisions.

That all being said, over 80% of market participants expect interest rate cuts by Chairman Jerome Powell and the Federal Reserve at both the November and December FOMC meetings.

Later today, we will have our answer for the November meeting.

The consensus is that interest rates in the United States will be down to 4.25% to 4.50% by the end of this year.

And if that were not enough to muddy all the waters, we have a very hostile and contentious U.S. presidential election that was just decided.

Differences and Similarities

As we transition to a new administration under President Trump, it is important to note that the policies of the two candidates are clearly different.

However, when it comes to fiscal responsibility, there really is no difference at all.

Both candidates vowed to leave Social Security. Medicare, and pensions alone. These massive entitlements will continue to weigh heavily on our overhanging debt, the U.S. dollar, and our economy.

Further, the fiscal plans for both candidates continue the pattern of both parties for over half a century… overspending and monetary expansion.

This bi-partisan overspending and monetary expansion is what is responsible for weaker U.S. dollars and higher prices for anything and everything. This bi-partisan overspending and monetary expansion is what is responsible for the decrease in our standard of living. This bi-partisan overspending and monetary expansion is what has made so many Americans to struggle to make ends meet… relying upon credit cards to buy necessities.

Congress and previous administrations have created these problems… from both sides of the aisle… from both sides of the political spectrum. They have tried and they will continue to try to blame others for inflation and a weak economy.

Overspending is the root of all these ills, and Congress and previous administrations are the only ones to blame.

And they have no will or desire to change.

Gold and Silver

If you know and accept all that, there really is only one thing to do. Ensure you have your wealth insurance policy in place.

Buy gold. Buy silver.

Unless the new administration and the new Congress changes course, the gold and silver prices are going higher in the long term. There is no other way for things to go.

If you have not allocated funds to gold and silver yet, do so. Your family’s financial future depends upon it.

Gold and silver help you preserve your purchasing power. They help you Keep What’s Yours!

Buy on our website directly… www.assetstrategies.com. Call us at 800-831-0007. Or send us an email.Take action today…

—Rich Checkan

Editor's Note: Jim Woods is the editor of Successful Investing, Bullseye Stock Trader, High Velocity Options, Fast Money Alert and his latest publication, Crypto & Commodities Trader. A self-described radical for capitalism, he celebrates the virtue of making money from his Southern California horse ranch.

Feature

Navigating the Trumpian Market Waters

By Jim Woods

In a remarkable political feat, former President Donald Trump is now once again President-elect Donald Trump.

Trump has now become only the second president to win two non-consecutive terms (the other was Grover Cleveland), as he thoroughly defeated Vice President Harris last night, both in the Electoral College and the popular vote! Nearly as importantly, Republicans also “flipped” the Senate while the House of Representatives remains officially undecided. However, given Trump’s sizeable margin of victory and the broad Republican outperformance in the Senate, it’s likely Republicans will win the House as well, ultimately creating a Republican sweep.

I know many of my readers (likely most) are overjoyed at last night’s result. I also know that many are disappointed. I know this, because so many have texted and emailed me expressing jubilance, while so many others have vented their anguish. It goes to show that my readers hold a variety of opinions, and that they take their convictions seriously.

As far as markets are concerned, well, the feeling is unequivocally in the jubilance camp.

Stocks roared to new, all-time highs “the morning after,” with the several notable election winners surging in anticipation of a return to Trump’s policies, which are seen as pro-growth, anti-regulation and anti-tax. Understandably, many readers have asked me if I think the Trump/Republican victory is a “gamechanger” for markets.

My answer is a bit more tepid than some might think, and that’s because while the election results will likely keep the throttle open for a continued rally into year-end, given the extended valuations here and the fact that the market has largely priced in a Trump win in the days leading up to Election Day, we aren’t likely to see a massive move higher in stocks from here.

That said, I love the fact that markets are surging today in anticipation of more capitalism out of 1600 Pennsylvania Avenue, so Mr. Trump and team, please bring that on! What I don’t want you to bring is all of that tariff rhetoric, because that is NOT pro capitalist. But hey, that’s a topic of many more discussions in the months and years to come.

Now, another series of questions I’ve received here is what sectors are most likely to perform, and which might underperform, given future Trump policies such as tax cuts, deregulation, focus on domestic industries and new trade relationships.

Here, my partners at Sevens Report Research and I think the likely market winners from this policy stance are value-oriented stocks, small-cap stocks, cyclical sectors and domestically focused sectors such as industrials, defense, energy/basic materials, transports, and especially banks and financials.

The likely underperformers going forward are the global trade sectors such as tech, communications, consumer discretionary, large-cap growth, China and emerging markets, defensive sectors, and large importers. That said, these market segments will likely still move higher given the wider milieu of solid economic growth and pending Federal Reserve rate cuts, but they will also likely lag the aforementioned outperformers.

Essentially, the Trump win and Republican sweep should continue the broadening of the rally we’ve all witnessed since July, where the “rest of the market” catches up with (and outperforms) mega-cap tech and growth factors.

Another set of questions that might be on your mind right now is about any potential market risks here given the new administration and Congress?

One risk is the return of rising bond yields. Rightly or not, the market views Republican control of Washington as negative for the debt and deficits. As a result, Treasury yields are up, and they’ve been rising in anticipation of a Trump win. Until we see the Trump administration ameliorate the fears of rising debt and deficits, this risk will continue.

The other big risk is trade wars. While Trump doesn’t have unchecked powers to levy tariffs, once his administration meets a burden of proof to green light tariffs against a country, then he will have broad and unchecked powers. For example, with goods from China, he does have broad powers. With countries where we already have trade deals/treaties (e.g. Mexico), he does not have broad powers. Still, the risk of increased trade volatility remains, so as investors we need to keep that in mind when making portfolio allocations.

Ok, so here is the real question I know you want me to answer: What is my favorite market segment given the election outcome?

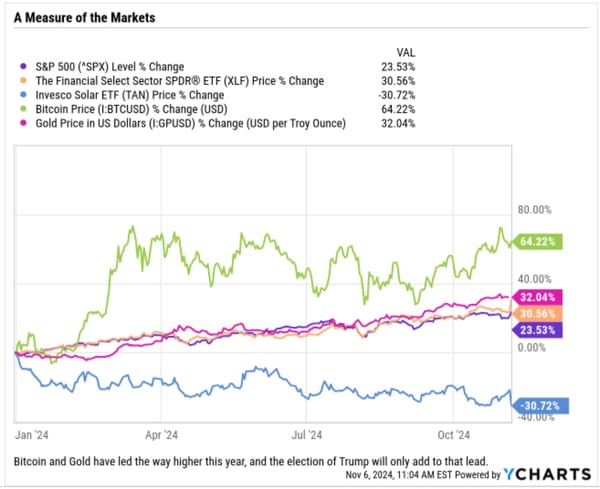

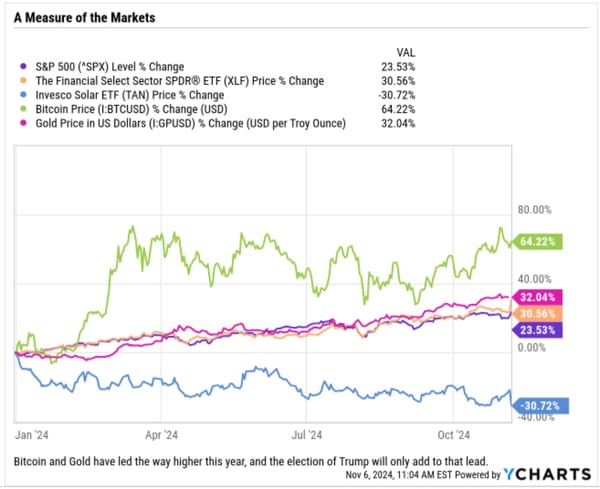

Certainly, stocks are likely to continue to do very well. And as it is regardless of politics, stocks with the strongest earnings growth, strongest share price performance, most bullish technical patterns and the most-bullish “NewsQ,” as I call it, will lead the way. I also think that despite this morning’s selloff, gold is likely to continue doing well, as its store-of-value status, and its proven resilience as a must-have form of “wealth insurance” holds true regardless of politics.

However, I think my biggest election winner is… cryptocurrencies.

Trump is very pro cryptocurrency, embracing the asset class while heavily courting the crypto community. I think this is a great thing, because crypto is an unstoppable force driven by demand and technology that cannot be denied or ignored.

Try as they may, and certainly SEC Chairman Gary Gensler has done just that, Bitcoin, Ethereum, Solana, etc., haven’t been stopped, because smart investors know this is the next big asset class for capturing alpha.

For example, in November 2020, when it was President-elect Biden, Bitcoin traded at $13,677. Today, four years later and President-elect Trump, it trades at nearly $75,000.

That’s a massive gain of nearly 450%!

I suspect that no matter how well your stock portfolio or your precious metals holdings performed, they didn’t perform that well over the past four years.

Yes, that ride has been volatile. And yes, it’s not for all of your money, nor is it for those who can’t stomach the volatility that comes with this asset class. Yet for those who want to be on the right side of investing history, I think you need to embrace cryptocurrencies, and you need to do so now, as President Trump will almost certainly be an advocate.

And to help you navigate the crypto and commodities space as we enter this next era of a favorable political climate, I recently launched my new trading service, Jim Woods’ Crypto & Commodities Trader.

The service is already off to a fantastic start, banking a 156% realized gain in the first six days! And now that Bitcoin is spiking on the Trump win, our holdings continue to surge.

So, if you want to learn how to expertly navigate the new Trumpian market waters, ones filled with crypto and commodity winners breaching the surface with the frivolity of a dolphin pod, then do so right now with me.

Because as you know, time and alpha are a terrible thing to waste.

Editor's Note: Frank Holmes is the CEO of U.S. Global Investors —a company that produces quality analysis concerning gold, precious metals, natural resources, and emerging markets—in conjunction with his work as a fund manager. Frank is a long-time friend of ours, and we've chosen to share his article originally published October 14, 2024. For more articles like this from Frank and other leading experts, you can subscribe to the U.S. Global Investors newsletter here.

Hard Stuff

Everything Gold is New Again

By Frank Holmes

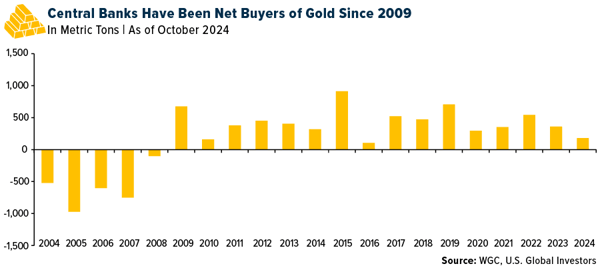

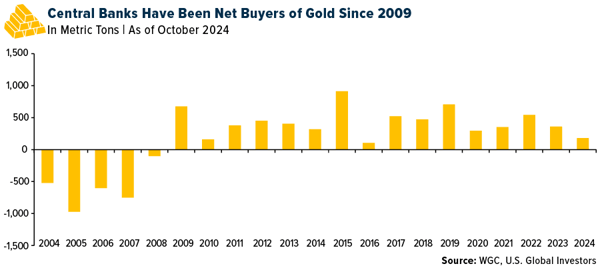

With over 36,000 metric tons in reserves—about one-fifth of all the gold ever mined—central banks know something we should too: Gold is the ultimate safety net. Since 2009, these institutions have been net buyers of the precious metal, and in the past decade alone, they’ve scooped up one out of every eight ounces produced globally.

If these guys are loading up on gold, shouldn’t that tell you something about where your own portfolio should be?

While fiat currencies can be printed at will (and we’ve seen plenty of that lately), gold remains a finite resource. I believe that makes it the go-to asset when economic uncertainty rears its head. Countries all over the globe have realized this, and they’ve been buying gold in bulk.

Here’s a look at the top 10 nations that have been piling up the most gold in the last decade, based on data supplied by the World Gold Council (WGC):

10. Hungary | 91.4 metric tons

The Hungarian National Bank has been holdings gold since it was created in 1924. Lately, it’s been serious about adding to its stockpile. With 110 metric tons in reserves, Hungary now boasts the highest per capita gold holdings in Central and Eastern Europe.

9. Qatar | 96.3 metric tons

Qatar views gold as a safe investment, especially during times of economic uncertainty. In recent years, Qatar’s gold purchases have soared, with holdings over 100 tons by the end of 2023. For a nation built on oil and gas wealth, it’s clear they see gold as a reliable backup plan.

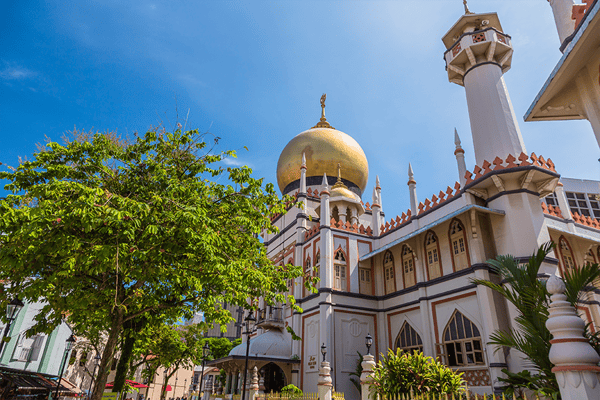

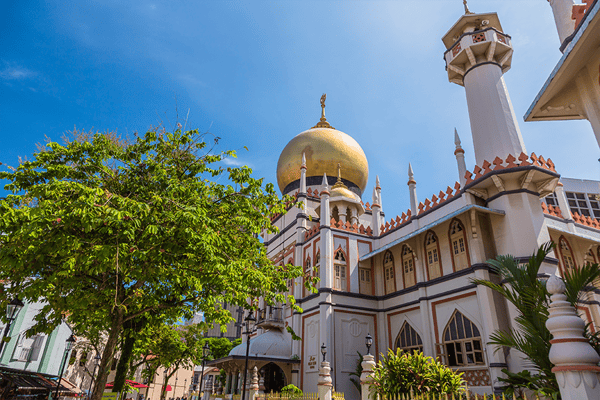

8. Singapore | 101.5 metric tons

Singapore is no stranger to gold, even if it has to import every ounce. This year, it made a historic move, bringing its gold reserves to 236 metric tons, the highest level since the city-state gained independence in 1965. A savvy play for a global financial hub like Singapore!

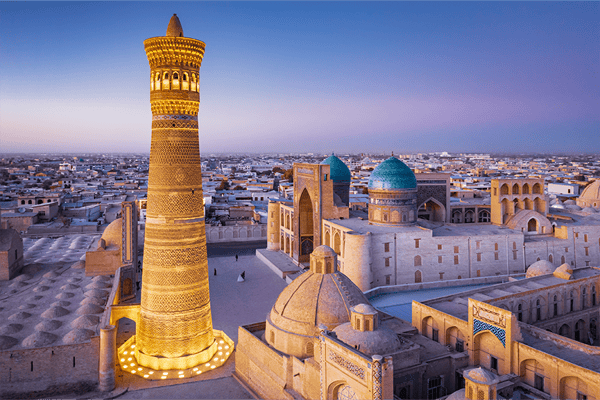

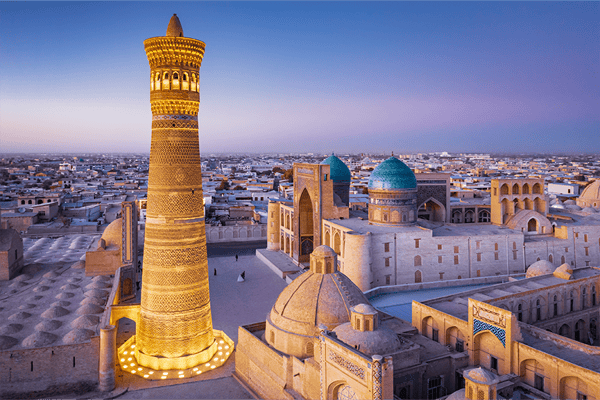

7. Uzbekistan | 126.3 metric tons

Uzbekistan has been a quiet yet powerful player in the gold market. Its reserves have grown steadily, hitting 373 tons in 2024. Almost 80% of Uzbekistan’s total international assets are now in the precious metal.

6. Kazakhstan | 132.6 metric ton

Kazakhstan, a top global gold producer, has steadily increased its reserves, which now stand at a combined $23 billion. The country plans to reduce gold’s share of its reserves slightly but remains a major player in the global market, accounting for 2% of global gold production.

5. India | 291.4 metric tons

India’s Reserve Bank has been making some big moves in the gold market. Its purchases in the first half of 2024 were the highest since 2013, surpassing the previous two years combined. For India, where gold holds deep cultural significance, the metal remains central to its economic strategy.

4. Poland | 295.0 metric tons

Poland’s National Bank has been one of the most aggressive gold buyers this year, tying with India for the largest purchase in the second quarter of 2024. With current holdings at 16%, Poland is on a mission to have the precious metal make up 20% of its reserves

3. Türkiye | 475.6 metric tons

Over the past decade, Türkiye has grown its gold reserves from 116 metric tons to over 584 tons today. With nearly 20% of its reserves in gold, Türkiye is one of the top buyers, thanks to its long history of domestic gold ownership and investment.

2. China | 1,210.2 metric tons

China is always one to watch, and it’s been no slouch in the gold department. Having added over 1,200 metric tons in the past 10 years, the People’s Bank of China sits just behind the U.S. in total global rankings. However, it hit pause on new purchases in recent months as gold prices surged.

1. Russia | 1,230.6 metric tons

Taking the top spot, Russia has added more than 1,200 tons of gold to its reserves over the last decade. With sanctions from the West in mind, Russia has been preparing, even going as far as to peg its currency, the ruble, to gold—a strategy we haven’t seen since the days of the Bretton Woods system.

At U.S. Global Investors, we’ve always seen gold as a key part of a diversified portfolio, and we believe our gold-focused funds offer an excellent way to participate in this time-tested asset. After all, if it’s good enough for central banks, shouldn’t it be good enough for you?

Editor's Note: Adrian Day is president of his eponymous money management firm, offering discretionary accounts in both global markets and resources. He also manages the Europac Gold Fund. To see if a managed account might be right for you, call ASI and we'll make the connection. Call 1-800-831-0007 for more information.

The Inside Story

This is the Time to Buy Gold Stocks as Market Dynamics Change

By Adrian Day

For the past two years, central banks around the world have been buying gold, and this year, Chinese retail buyers boosted their buying. These two groups drove gold up, even as Western investors continued to sell. These two groups were buying for their own idiosyncratic reasons–-to diversify their reserves in the face of dollar weaponization for the former, and concern about the economy and banking system for the latter–-reasons that had little influence on Western investors.

Now, as the Federal Reserve embarks on a rate-cutting cycle, U.S. and other Western investors have started to buy. The past two years were but a prologue; now the curtain is going up and the play about to begin.

Until the last couple of months, the macro economic environment, particularly in the West, was not conducive for gold investments. High interest rates; (seemingly) low and falling inflation; high real interest rates; a (seemingly) strong economy; and a relatively strong dollar: this is precisely the worst economic environment for gold. Add to this mix a strong stock market, and gold stocks were just about the last investment class one would think would do well.

Now Western Investors Are Slowly Turning to Gold

This is changing, of course. The Fed cut rates for the first time after a rate-hiking cycle, and that switch always sparks a gold rally. Though the inflation numbers have come down, they have now flattened for the past five months. Importantly, they remain above where they stood pre-Covid, and well above the Fed’s own arbitrary 2% target.

The Fed’s rate cut sparked a shift from Western investors from selling to buying physical. Gold ETFs, which had experienced net outflows for most of the year, saw increasing inflows particularly in September and they have continued in October. This quarter saw the first net inflows since the first quarter of 2022.

This Western investor demand has replaced the slowdown in central bank and Chinese demand that had been the main drivers of the gold price for the previous two years. In the third quarter, central bank and Chinese retail buying both declined, according to a report from the World Gold Council. Central bank buying dropped almost 50% from the year-ago quarter, though that was a peak, and central bank buying remains high on an historical basis. Chinese buying plunged, to 36% below its 10-year average.

The reasons different groups have been buying gold have not gone away. This is true whether we are talking about central banks diversifying their reserves amid the “weaponization of the dollar”; Chinese investors concerned about their domestic economy; or Western investors seeing lower interest rates ahead even as inflation remains stubborn. However, after such strong central bank buying for the past two years, and the surge in Chinese buying earlier this year, the slowdown from these sources may continue for a while.

But this buying is not going away, and won’t turn negative. Western buying, however, is likely to continue to increase, as most investors, be they retail, funds or institutions, are meaningfully underweight relative to their historical averages. And none of this will change regardless of who wins the election this coming week: the weaponization of the dollar, and the huge fiscal deficits are likely to continue.

Gold Stocks Just Beginning to Outperform

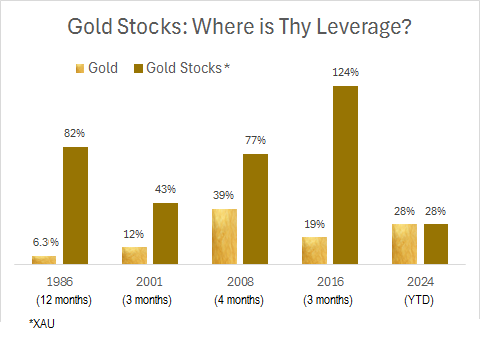

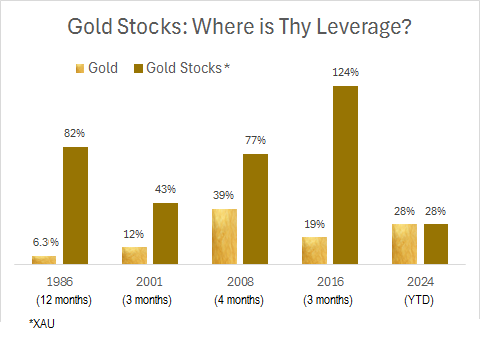

So gold will continue to move higher, we believe. Typically, gold stocks well outperform gold at the beginning of a bull market. The chart above shows the outperformance of gold stocks in different periods from the time gold itself bottoms. That outperformance can be very strong. This time, however, we have not seen any such outperformance. Indeed, from the turn in October 2022, the gold stocks have actually lagged gold.

That is readily explained by who was driving gold until the last couple of months. Central banks buy gold bullion; they do not buy gold stocks. Chinese consumers buy physical gold; they do not buy gold stocks. Now that the Federal Reserve has started to cut rates and Western buying are coming back too the market, we are beginning to see inflows into gold equity funds and with it the outperformance one expects from the gold stocks. So far, it is only very slight outperformance, but that will change as the inflows pick up.

Gold stocks have had the highest cash flow growth of any segment of the stock market this year. A third quarter of increasing cash flow will surely start to gain the attention of more generalist investors, particularly as several of the “Magnificent Seven” erstwhile market leaders start to falter.

By cutting rates before inflation is vanquished, the Fed risks a stagflationary environment. And gold and gold stocks historically have been the best-performing asset during a stagflation.

Gold Stocks Remain Undervalued Even Amid Strong Outlook

Not only is the outlook for gold stocks strong. But they remain very undervalued. Agnico Eagle, the third-largest miner, for example, is trading at a multiple of less than 10 times its cash flow. This is very close to its all-time low multiple, astonishing given that multiples normally expand as the gold price moves up.

U.S. investors, including mutual funds and institutions, are significantly underweight gold stocks. Across all investors, the allocation to gold is less than 0.5%. If the longer-term average for U.S. investors to 2% or higher, then there is significant room for additional buying. Even in September, most gold mutual funds continued to see net outflows, some quite large, though certainly there has been a shift toward inflows, particularly at the end of the month and into October.

This is an unusual confluence of record gold prices and low gold stock valuations, and an excellent time to step up investing in this space.

Editor's Note: Arthur Bavelas is Founder of Family Office Insights, a pioneer in developing one of the first private opportunity review networks. Arthur is a globally recognized entrepreneur, author, and family office investor. He is the host of the Arthur’s Round Table Series, and creator of the Family Office Funding Challenge , Global Business Network, The Family Office Impact Summit, Creator of The Bavelas Index (TBI)™ Family Office Investor Sentiment Index™

Bonus

Trends & Methods in Owning, Storing, and Avoiding Scams When Acquiring Precious Metals

By Arthur Bavelas

Arthur's Round Table podcast is known for conversations with leading entrepreneurs and investors. Last week he sat down with Rich Checkan of Asset Strategies International to discuss trends & methods in owning, storing, and avoiding scams when acquiring precious metals.

Click to view.

|