|

Perspective

By Rich Checkan

I usually start this issue by wishing you a Happy New Year, looking at the performance of the markets over the past year, and sharing what I see for the coming year.

But there is something so much more important to share with you first.

According to Bloomberg, Treasury Secretary Janet Yellen announced last Friday in an interview with CNN that a soft landing has been achieved!

In her own words…

“What we’re seeing now I think we can describe as a soft landing, and my hope is that it will continue.”

She went on to share how American workers were getting ahead as wages were exceeding inflation.

Isn’t that great?!?

Unfortunately, Secretary Yellen’s declaration of a “soft landing” is as effective as when Michael Scott yelled, “I declare bankruptcy!” on The Office.

It makes for a great sound bite, but the problem is far from solved.

Secretary Yellen, Chairman Powell, the Federal Reserve, and Congress have quite simply lost touch with the American people and what the real economy is doing right now.

More on that in a second. But first…

Happy New Year!

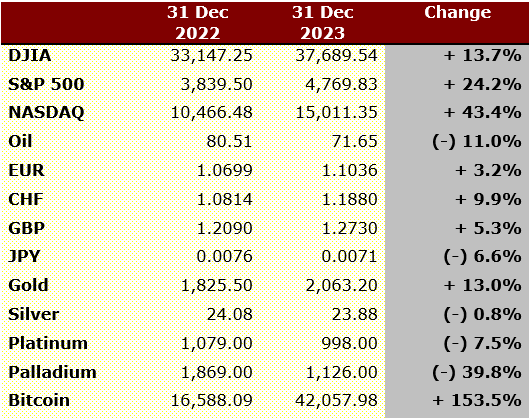

Now, let us take a look at the numbers for 2023…

What Happened?

As we discussed a week ago, the year started off with a banking crisis that sent everyone running to gold.

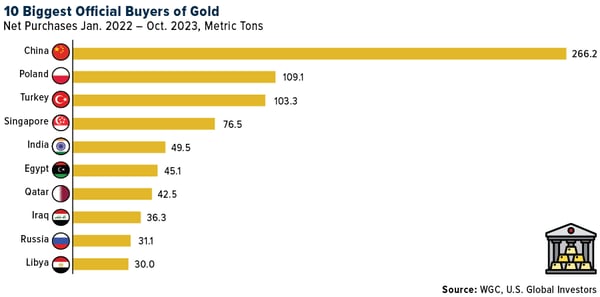

By mid-year, most everyone believed the crisis was over. So, all attention returned to the Federal Reserve and their “higher for longer” mantra. This capped growth in the markets and left gold in range supported primarily by central bank gold purchases… which were outpacing last year’s historic surge.

In October and November, attention returned to safe haven gold purchases after the Hamas attack on Israel. Then, at the end of the year, Federal Reserve Chairman Powell suggested there might be as many as three rate cuts this year.

That sent gold, silver, and equities surging… until the Fed minutes of the December meeting came out suggesting that many members of the Federal Open Market Committee (FOMC) believed rates would need to stay higher for some time.

Perhaps Treasury Secretary Yellen should have consulted with Chairman Powell before she declared victory over inflation.

What’s Next?

Simple.

The Federal Reserve holds interest rates steady for as long as they can until something breaks… until we achieve that inevitable bumpy or hard landing.

That hard landing could be a recession. It could be a broken labor market. It could be another, more serious banking crisis triggered by commercial real estate distress.

Whatever the cause, the Federal Reserve will move from a pause in interest rate increases to a pivot. Interest rates will start to fall.

That will trigger another everything bubble as easy money floods the economy once again.

Against that backdrop, expect an election cycle as contentious as any you have ever lived through. Name-calling and mudslinging will replace any sort of meaningful dialogue.

The first act of this drama is rapidly approaching with the January 19th government shutdown deadline. A spending bill needs to be in place by then to avoid a partial government shutdown… and by February 2nd to avoid a full shutdown.

Meanwhile legal attacks on political opponents continue from both sides of the aisle. Former President Trump is mired in legal battles and ballot-blocking shenanigans. Not to be outdone, the Republicans are moving forward with an impeachment inquiry into President Biden.

Expect nothing this year in the way of progress toward cutting spending, balancing budgets, or reducing the gargantuan U.S. government debt.

I fully expect lower interest rates, increased money supply, and bubbles everywhere by year end… although I do hope I am wrong.

What about Gold and Silver?

Gold showed incredible resilience last year despite a stronger U.S. dollar and significantly higher Treasury yields.

This year, once the pivot begins, I fully expect gold to shine.

Let’s face it, gold is needed now more than ever. That is precisely why central banks have been buying it for the past few years with both hands. It is a proven store of purchasing power. It is a proven hedge against geopolitical and financial crises.

It is exactly what the doctor ordered for 2024.

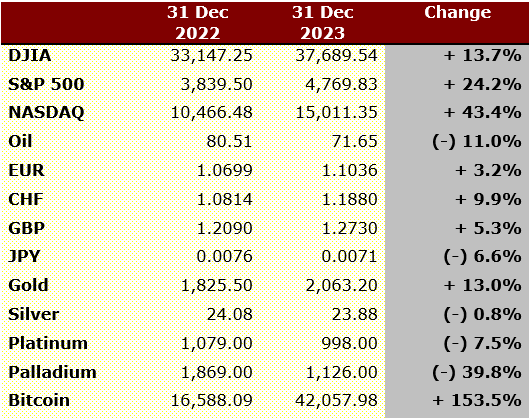

As for silver, its time is certainly coming. It has lagged gold significantly over the past year. Gold was the top-performing commodity last year… up 13% for the year.

Silver lost twenty cents an ounce for the year… down nearly 1%.

Once silver gets going, it should easily outperform gold. For that reason, I like silver for profit motive here. But for wealth insurance, there is absolutely nothing better than gold.

Expect both gold and silver to shine in the second half of 2024… and into 2025.

Call us at 800-831-0007 or send us an email to set-up a consultation… now… today! Let us help you ensure your retirement and non-retirement portfolios are protected against depreciating U.S. dollars.

And… most importantly, from our hearts to yours, best wishes from all of us for a Happy, HEALTHY, and Prosperous New Year!

—Rich Checkan

Editor's Note: Jim Woods is a 30-plus-year veteran of the markets with varied experience as a broker, hedge fund trader, financial writer, author and newsletter editor. A slightly modified version of this article originally appeared in The Deep Woods e-letter on January 3.

Feature

The "Big Five" Market Assumptions Into 2024

By Jim Woods

You know what they say about assumptions? That’s right, they can make a “you-know-what” out of “u” and “me.”

Unfortunately, when it comes to markets, the folly of assumptions can do just that to many a confident and otherwise sophisticated investor. For example, just think about where we were last year at this time. The S&P 500 had just logged its worst annual performance since the financial crisis, the Federal Reserve was in the midst of the most aggressive rate hike campaign in decades, inflation was above 6% and concerns about an imminent recession were pervasive across Wall Street.

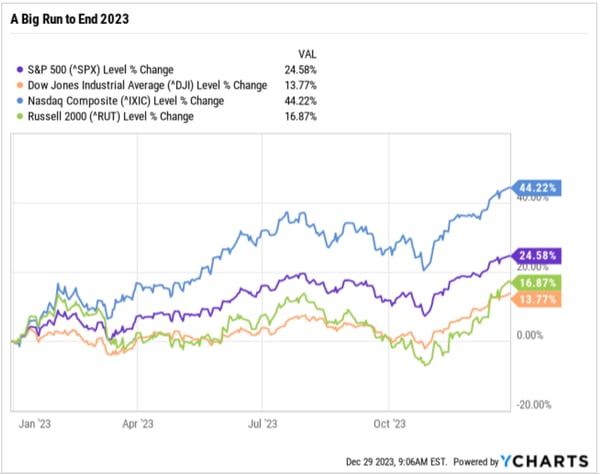

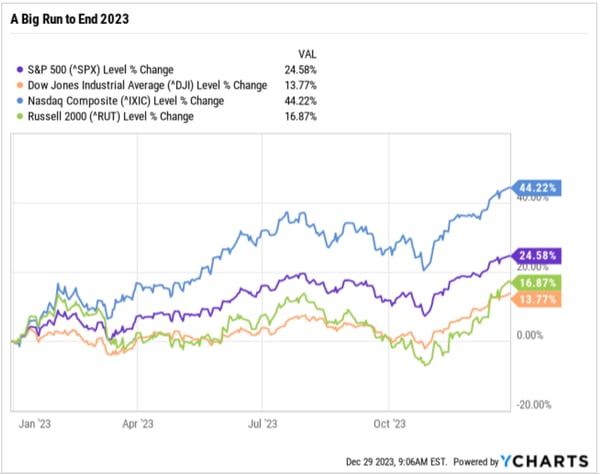

That bearish cocktail conjured market assumptions of more doom and gloom for 2023, one where the bears would devastate the bulls for a second consecutive year. Of course, we all know what happened. The S&P 500 finished the year with a gain north of 24%, while the Nasdaq Composite soared nearly 44%.

As we start 2024, the market outlook couldn’t be much more positive than it was a year ago.

The Fed is done with rate hikes and rate cuts are on the way, likely in early 2024. Economic growth has proven more resilient than most could have expected, and fears of a recession are all but dead. Inflation dropped substantially in 2023 and is not far from the Fed’s target, and corporate earnings growth is expected to resume this year.

So, yes, we are definitely in a more positive environment for investors compared to the start of 2023. However, just like overly pessimistic assumptions for 2023 proved incorrect, as we look ahead to 2024, we must guard against overly optimistic assumptions, because at current levels both stocks and bonds have priced in a lot of positives in the new year.

Consider first that the S&P 500 is starting 2024 trading at a very lofty 19.5X valuation. Now, I’m not saying that valuation is unjustified, but I will say that this valuation makes several positive assumptions about critical market influences in the coming year. How reality matches up with those assumptions will determine whether stocks extend the rally (and the S&P 500 hits new highs and makes a run at 5,000) or gives back much of the Q4 Santa Claus rally.

In a recent issue of my daily market briefing, Eagle Eye Opener, we defined the five most important assumptions investors are making right now, because it’s how reality plays out versus these assumptions that will determine if stocks and other assets rise or fall in Q1 and 2024. Let’s take a look at each now.

Assumption 1: Fed cuts rate six times for 150 basis points of easing and a year-end Fed Funds rate below 4.0%. The main factor behind the S&P 500’s big Q4 rally was the assumption that the Fed was done with rate hikes and would be cutting rates early and aggressively in 2024. How do we know this is a market assumption? Fed fund futures. According to Fed fund futures, there’s a 70%-ish probability the Fed fund rates finishes 2024 between 3.50-4.00%.

Assumption 2: No Economic Slowdown. Markets haven’t just priced in a soft landing, they’ve priced in effectively no economic slowdown as investors expect growth to remain resilient and inflation to decline, the oft-mentioned “Immaculate Disinflation,” a concept that’s possible, but to my knowledge has never actually happened. How do we know this is a market assumption? The market multiple. The S&P 500 is trading at 19.5X the $245 expected S&P 500 earnings expectation. A 19.5X multiple is one that assumes zero economic slowdown (if markets were expecting a mild slowdown, a 17-18X multiple would be more appropriate).

Assumption 3: Solid earnings growth. Markets are expecting above average earnings growth for the S&P 500 to help power further gains in stocks. How do we know this is a market assumption? The consensus expectations for 2024 S&P 500 earnings per share are mostly between $245-250. That’s nearly 10% higher than the currently expected $225-per-share earnings for last year (2023), which points to very strong annual corporate earnings growth.

Assumption 4: No additional geopolitical turmoil. Despite the ongoing Russia/Ukraine war, Israel/Hamas conflict and escalating tensions between the U.S.- and Iranian-backed militias throughout the Middle East, the market’s assuming no material increase in geopolitical turmoil. How do we know this is a market assumption? Oil prices. If markets were nervous about geopolitics, Brent Crude prices would be solidly higher than the current $77/bbl. Oil prices in the high $80s to low $90s reflect elevated geopolitical concern while prices above $100/bbl reflect real worry.

Assumption 5: No domestic political chaos. This is an election year in the United States. Republican front-runner Donald Trump is facing a long list of various civil and criminal charges along with challenges to whether his name will be on the ballot in certain states. Meanwhile, there has been no long-term compromise on funding the government, so shutdown scares remain a real possibility. And that’s before we get into the heart of election season later this year. How do we know this is a market assumption? Treasury yields. A 4.00%-ish yield on the 10-year Treasury does not reflect much domestic political angst. If markets become nervous about the U.S. political situation and/or fiscal situation in the United States, the 10-year yield would be sharply higher than it is now (well above 4.00%, like we saw in the late summer/early fall).

Bottom line, these market assumptions aren’t necessarily wrong. Events could unfold the way the market currently expects. But these assumptions are aggressively optimistic, and it is how events unfold versus these expectations that will determine how stocks and bonds trade to start the year.

Finally, if you are banking on all of these assumptions coming to fruition in 2024, I caution you to heed the warning about assumptions that we began with. What you definitely don’t want to ever do is to make a “you-know-what” out of “u” and “me” when it comes to your money.

Editor's Note: Brett Eversole joined Stansberry Research in 2010. He is the lead editor and analyst for True Wealth, True Wealth Systems, True Wealth Real Estate, and DailyWealth. This article originally appeared in DailyWealth on January 4, 2024.

Hard Stuff

Gold Can Rally Another 13% After Hitting a New High

By Brett Eversole

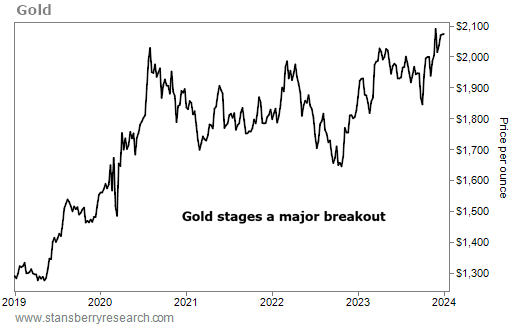

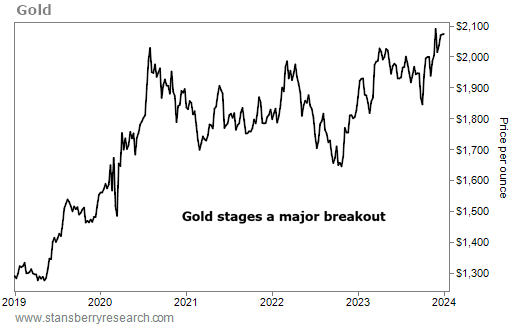

Gold broke above $2,000 an ounce in late October. But it didn't stop there...

The metal kept rising throughout November. And it even hit a new all-time high on the first day of December. Now, it's darn close to those levels once again.

Gold has tried (and failed) to hit new highs above $2,000 several times in recent years. Between those failed breakouts and gold's poor performance as an inflation hedge, many investors have given up on it.

That's a mistake.

History shows that gold will likely keep heading higher from here. In fact, the recent breakout points to double-digit upside over the next year.

Let me explain...

Breaking above $2,000 an ounce has proved problematic for gold. The metal has punched through that level three other times in the past four years... But it has never held on to those gains.

This time could be different. That's because sentiment is bearish despite the recent breakout...

Investors just aren't that interested in gold. Shares outstanding of the largest gold exchange-traded fund are well below 2020 levels today. And the Commitment of Traders report for gold shows that futures traders are still bearish on the metal, too.

However, the recent breakout points to more gains ahead. Not only did the metal hit a new all-time high, but it also hit a new 52-week high in the process. Take a look...

Gold prices remain near all-time highs today. And we should view that as an opportunity to act.

You see, the trend is in your favor if you buy after a major breakout. And if there's one thing I love as an investor, it's sticking with the trend.

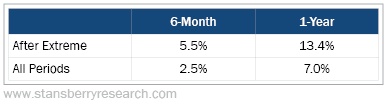

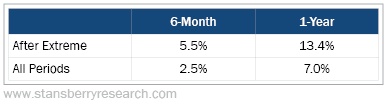

Again, the recent breakout triggered a new 52-week high. That isn't too common for gold. We've only seen 37 other instances in the past 50 years. But according to history, buying after these rare setups can lead to solid upside. Check it out...

Gold has a long history of impressive returns. They've nearly matched the returns of stocks over the past five decades, leading to annual gains of 7%. But you can do much better by buying after a new 52-week high.

Similar instances led to 5.5% gains in six months and 13.4% gains over the following year. That's nearly double the typical one-year return. And it means gold's recent breakout can continue.

Like I said earlier, sentiment is negative for the metal despite hitting new highs. But that's just another reason to expect the gains to continue.

So if you've forgotten about gold, now is the time to take a closer look. The recent gains are likely only the beginning of this rally.

Editor's Note: Frank Holmes is the CEO of U.S. Global Investors —a company that produces quality analysis concerning gold, precious metals, natural resources, and emerging markets—in conjunction with his work as a fund manager. Frank is a long-time friend of ours, and we've chosen to share his article originally published January 2, 2024. For more articles like this from Frank and other leading experts, you can subscribe to the U.S. Global Investors newsletter here.

The Inside Story

The Federal Reserve’s Balancing Act Between Inflation and Growth

By Frank Holmes

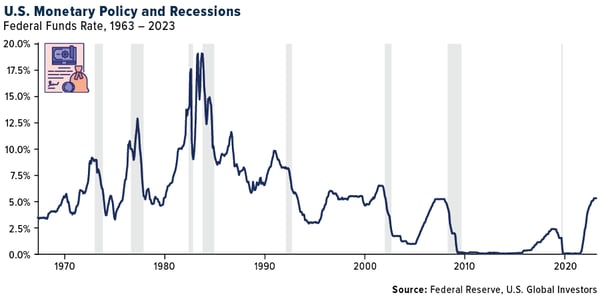

Soft landings, it has been said, are the holy grail of monetary policy, and there may be signs that we’re on the cusp of one. But what does it mean for the economy in 2024 to have a soft landing? And conversely, what constitutes a hard landing?

Simply put, a soft landing occurs when the Federal Reserve manages to curb inflation without triggering a sharp increase in unemployment or pushing GDP growth into negative territory.

A hard landing, on the other hand, is when interest rates rise and inflation decreases, but at the cost of a recession and high unemployment.

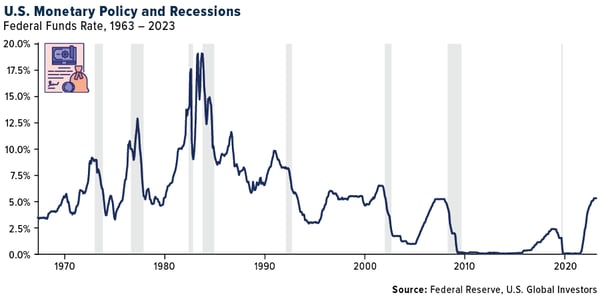

Achieving a soft landing is exceptionally challenging. Noted MIT economist Rudi Dornbusch (1942-2002) famously quipped: “None of the post-war expansions died of old age. They were all murdered by the Fed.” Indeed, out of nine tightening cycles over the past five decades, the bank successfully engineered a soft landing only twice. The other seven instances culminated in recessions.

Princeton economics professor Alan Blinder offers some hope. If the need to combat inflation is not too extreme, he writes in a recent article, the Fed has demonstrated its ability to orchestrate an economic landing that either avoids a recession or induces a relatively mild one. The central bank’s reputation for causing hard landings “derives mainly from conquering the 1970s inflation—which took three landings,” Blinder says.

The key to predicting the outcome in 2024 lies in economic indicators, especially as experts project the consumer price index (CPI) in the U.S. to decline to 2.7% while the Fed’s target rate is expected to reach 4.50% by the end of the year.

A Global Leader In Numerous Industries

Despite the occasional gloomy predictions and forecasts, investors should be cautious about buying into the “America-is-in-decline” narrative, Merrill points out in its weekly Capital Market Outlook.

America’s share of global gross domestic product (GDP), estimated at 26% for 2023, has increased from 24.8% at the start of the decade. Over the past four years, the U.S. economy has added an additional $6 trillion to its economic base, bringing total U.S. output to around $27 trillion. Most impressively, since the beginning of the decade, the S&P 500 has consistently outperformed most developed and emerging markets.

Investors have been treated to a promising holiday season, characterized by strong consumption. Mastercard reports a year-over-year increase of +3.1% in U.S. retail sales, excluding automobiles, during the 2023 holiday shopping season from November 1 through December 24. This measure encompasses both in-store and online retail sales across all payment forms and is not adjusted for inflation.

Finally, the Santa Claus rally appears to be in place. This phenomenon describes a period where the stock market closes higher during the last five trading days of the current year and the first three trading days of the new year.

“Where else in the world is there an economy that leads or dominates in so many diverse industries, ranging from agriculture to aerospace, education to entertainment, and technology to transportation, to name just a few sectors?” asks Joseph Quinlan, head of Merrill’s market strategy.

I couldn’t have said it better myself.

Gold’s Prospects In A Soft-Landing Scenario

In the context of a potential soft landing, historical trends suggest that gold may not perform as strongly. According to the World Gold Council (WGC), soft landing environments have typically resulted in flat to slightly negative average returns for gold.

However, every cycle is unique, and 2024 may bring surprises.

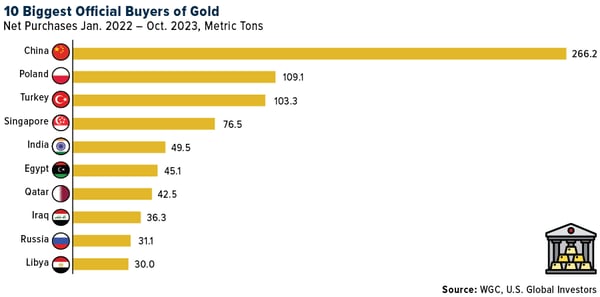

Heightened geopolitical tensions in a key election year for many major economies, combined with continued central bank buying, could provide additional support for gold. Central banks and official institutions have played a pivotal role in boosting gold’s performance over the past two years, with the WGC estimating that excess central bank demand added 10% or more to gold’s gains in 2023. This trend is likely to persist, potentially providing an extra boost to gold prices in 2024.

In the event that a recession becomes a reality, weaker growth could help steer inflation back toward central bank targets, eventually leading to interest rate cuts. Such an environment has been conducive to both gold and high-quality government bonds, making them appealing options for investors, the WGC says.

As we enter 2024, it’s essential for investors to remain vigilant, monitor economic indicators closely and consider the various possibilities that lie ahead. While the prospect of a soft landing offers optimism, the financial landscape remains subject to change. By recognizing the strength of the U.S. in the global economy and staying attuned to market dynamics, investors can position themselves for success in the new year.

|