|

Perspective

By Rich Checkan

I am making it my personal mission to get investors off the fence… for their own good.

Help me succeed.

I know you have heard me say this multiple times over the past year…

“At all-time highs, gold is dirt cheap.”

It was true a year ago. It is true today.

Take a look at this chart…

As I wrote to you last month, gold had just made new all-time highs. Over the past month, gold’s surge has continued. This week, gold was $100 more per ounce than last month’s record price.

It is easy to get caught-up in the price action. Some investors see the new high as the destination. They believe (or more likely hope) that gold has hit its peak price and will pull back for them to acquire it more cost-effectively.

But they have it all wrong.

Aside from a brief spike in the gold price as a result of the Covid pandemic, gold has been consolidating for years between $1,800 and $2,100 per ounce. That is not the price action of a metal at its peak.

Rather, it is the price action of metal building a base of support for the next leg up. Gold has not been banging its head on the ceiling. Gold has been building the launching pad for the next bull market.

I hear a lot of investors bemoaning the fact they did not buy gold sooner. As a result, they feel they have missed out, and they are hoping for a pullback to acquire some.

This is not rational thinking. This is an emotional reaction.

The Best Time To Buy Gold

Given the current environment, the absolute best time to buy gold was yesterday. The next best time is today.

Why do I say that?

Simple. Gold has been building up energy for this move for several years. It has a firm base of support. All it needs now are investors.

Up to this point, the gold price has been supported in this consolidation phase by purchases from high-net-worth investors and by central banks.

However, with the hint of interest rate cuts on the horizon, everyday investors are warming to gold… and they should.

No presidential candidate has the intestinal fortitude to cut entitlements. Nobody in Congress has the intestinal fortitude to cut spending and balance a budget.

Unless that changes, the gold price will go higher over time.

Let me say that again…

Unless that changes, the gold price will go higher over time.

We cannot afford the entitlements that are promised… Medicare, Medicaid, Social Security, Pensions. We cannot afford to pay for the things Congress has agreed to buy in the budget. Heck, soon, we will not even be able to afford the interest on our $34 trillion national debt.

As a result, and so as not to have a currency default, they will expand the money supply. That will water down the value of every dollar in circulation. And, as a result, that will cause the cost of everything of any value whatsoever to move higher in price.

There is absolutely no alternative once Congress and the President overspend.

Gold’s price will go higher.

The question for you is, “Do you want to buy gold now, or do you want to buy more expensive gold in the future?”

What About Silver?

Not surprisingly, the silver story is very similar to gold’s story.

Take a look at this 5-year silver price chart…

The basic story is the same. After a short spike as a result of the Covid-19 pandemic, silver has been range trading as well.

You would expect that. Silver follows gold in the trend (up or down) once gold establishes the trend. Then, historically, silver tends to outpace gold, whether the trend is up or down.

So, silver has been consolidating between $20 and $26 per ounce for the past few years as well.

But here is the big difference between gold and silver…

Gold’s consolidation was just below its all-time highs. Silver’s consolidation has been at 50% of its all-time highs. Which is why many believe the upward potential in silver is far greater than gold’s upward potential… myself included.

That is why I love gold as wealth insurance, and I love silver for a profit potential.

I buy gold, and I never sell it… unless I have a financial crisis.

I buy silver, and I sell when the market switches from bull to bear.

Actions To Take…

Buy gold and silver today, while gold is cheap at all-time highs… and silver is even cheaper.

There is no better way I know to Keep What’s Yours!

Buy on our website directly… www.assetstrategies.com. Call us at 800-831-0007. Or, send us an email.

—Rich Checkan

Editor's Note: Jim Woods is a 30-plus-year veteran of the markets with varied experience as a broker, hedge fund trader, financial writer, author and newsletter editor. Jim Woods is the Editor of the Successful Investing, Bullseye Stock Trader and The Deep Woods newsletters. An unrepentant radical for capitalism, he celebrates the virtue of making money from his Southern California horse ranch.

Feature

Drinking Up the Bullish 2024 Market Cocktail

By Jim Woods

Would you like to know the recipe for the most fashionable craft cocktail on Wall Street today?

I know you do, so let me lay it on you right now.

Bullish 2024 Market Cocktail: One-part stable economic growth, one-part falling inflation, one-part impending interest rate cuts, one-part artificial intelligence (AI) promise.

Mix ingredients in a “FOMO” (fear of missing out) shaker, pour in a martini glass, then add a little Bitcoin-flavored sugar to the rim to make it taste even sweeter. Oh, and don’t forget that golden garnish, as gold just shined to a new, all-time high.

Now, you can’t just order this cocktail in any of the swanky Lower Manhattan bars of the sort I used to frequent when I worked at the World Trade Center in the late 1990s. But what you can do is make this cocktail work for you in your investment portfolio, as the gains we’ve seen in stocks—particularly tech stocks tied to the AI wave—have vaulted the major indices to new, all-time highs.

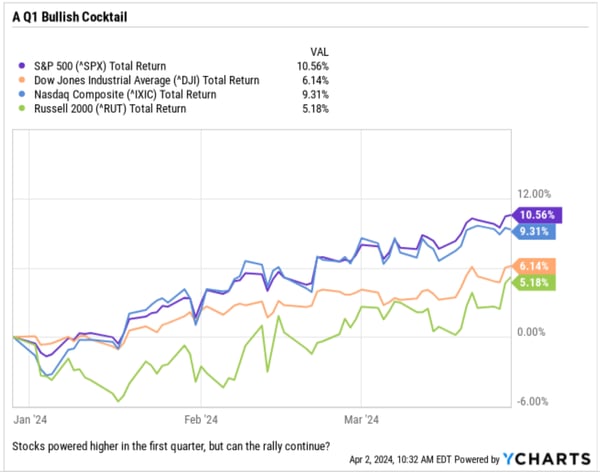

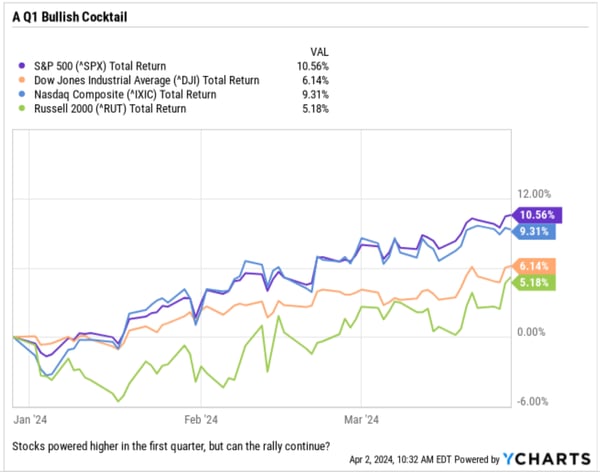

On March 20, all three major domestic indices—Dow Jones Industrial Average, S&P 500 and Nasdaq Composite—all broke out to close at record high levels. The big driver of that March 20 buying was, of course, the Federal Reserve, as it had just concluded its March Federal Open Market Committee (FOMC) meeting.

The Fed left rates unchanged, as we all expected, and the practical impact of the so-called

“dot plot” (where Fed members think interest rates will be by year-end), along with reassurances by Federal Reserve Chairman Jerome Powell that the FOMC is done hiking and will cut as soon as the data allows, is that markets continue to expect a June rate hike. That means that the “impending interest rate cuts” ingredient of the bullish cocktail was confirmed on March 20.

Of course, as a reader of Information Line, I suspect you like to look a little deeper “under the hood” to find out if there’s any trouble with the bullish engine. If there was an under-the-hood takeaway from the Fed, it’s that the major focus for investors right now needs to be on growth and specifically whether growth can hold up.

During his press conference, Chair Powell hinted that the Fed was a bit more worried about growth than the market currently expects. And the takeaway here is that the market is not getting more than three rate cuts in 2024 unless growth rolls over. And if that happens, at that point it’s too late anyway.

This matters because it implies that rates are indeed going to be mostly higher for longer and higher rates will continue to act as a headwind on growth. Stated differently, the major relief from high rates that investors keyed on during the Q4, 2023 rally is not coming. Yes, the Fed did confirm that it expects there to be two-to-three rate cuts by year-end barring a growth rollover. However, we’re still going to exit 2024 with the federal funds rate over 4.5%.

So far, this market has tolerated the disappointment of not getting what it thought it would quite well (remember, markets started the year expecting five-to-six rate cuts, with the first cut at the March meeting), and that’s largely because of two reasons.

First, AI enthusiasm continues to rage and that’s helping keep the bull market running. Second (and this is more fundamentally important), it’s because growth has held up.

You see, the market doesn’t care if we get fewer rate hikes as long as growth isn’t showing any signs of cracking. But if those signs of cracking do start to appear, then the fact that there will only have been one rate cut by July will matter, a lot, because policy will be viewed as restrictive and the outlook for markets will change, potentially violently.

The bottom line here is that with Fed policy known and major relief on rates not coming in 2024, we must focus on growth to make sure we see, as early as possible, any evidence of a rollover, because if that happens it’s a major problem for this market.

For now, the bullish cocktail of solid growth, falling inflation, impending interest rate cuts and AI enthusiasm is being served up fresh right now at the greatest capitalist watering hole of them all, the U.S. stock market. And until multiple ingredients in our cocktail go missing, the path of least resistance in this market remains higher and any modest pullbacks here should be viewed as entry points.

So, if you are currently on the sidelines waiting to get into this market, don’t hesitate any further. Make your move into the greatest wealth-building tool ever created, and start being the capitalist that it is your birthright to be.

If you don’t, then you only have fear of loss to blame—and fear of loss usually means you’re going to lose.

Editor's Note: Brett Eversole joined Stansberry Research in 2010. He is the lead editor and analyst for True Wealth, True Wealth Systems, True Wealth Real Estate, and DailyWealth. This article originally appeared in DailyWealth on April 2, 2024.

Hard Stuff

Gold's Massive Breakout Isn't Over Yet

By Brett Eversole

There was a full-blown gold mania underway when I started in the world of finance...

It was 2010. You couldn't even turn on the TV without seeing ads for the metal. And every time you drove down the street, you'd see more signs shouting "WE BUY GOLD" in shop windows.

The metal was years into its bull market by then. Prices were soaring. And investors couldn't get enough. It was pure mania.

It's a different story today. Gold recently broke out to an all-time high... But as we covered two weeks ago, sentiment is still far from euphoric levels.

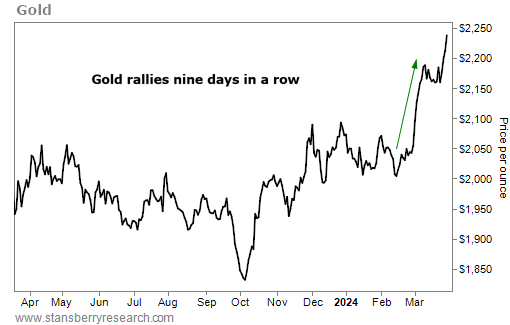

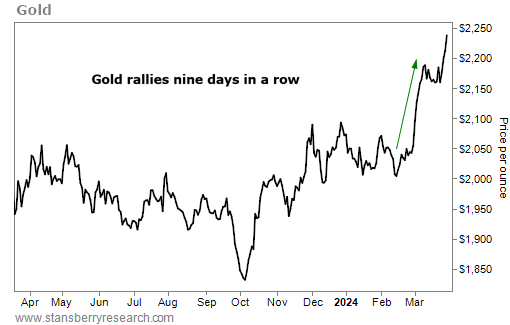

The recent rally did hit a rare level, though. The metal rallied for nine straight days. And according to history, that's a strong sign of more gains to come...

When an asset goes up day after day, it means there are more buyers than sellers. They want to own that asset. And their bids aren't slowing down.

This situation doesn't happen often... even in bull markets. And it's a signal that a boom is heating up.

Gold recently moved higher for nine straight days. That's darn rare. This kind of winning streak has happened just seven times over the past 50 years. Take a look...

A multiday spike like this is important... because rare setups like these point to continued gains.

To see it, I looked at every unique instance of gold rising for seven or more consecutive days. This gives us a bigger sample of 31 cases. Gold tends to keep rising after these setups. Check it out...

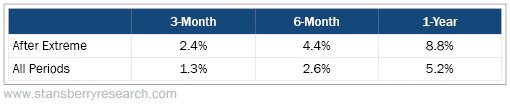

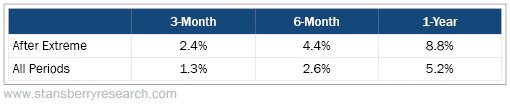

Long-term gold investors have made good money. The metal has returned 5.2% per year over the past half-century.

That includes plenty of ups and downs along the way. But buying at the right time – after moves like these – can lead to much better returns...

Similar setups have led to 2.4% gains in three months, 4.4% gains in six months, and 8.8% gains over the following year. That's solid outperformance in all cases.

Even better, most investors are still completely overlooking gold right now. That's almost never the case when an asset reaches new all-time highs. And it tells me that the current rally isn't about to end... It's just heating up.

The masses will wake up to what's happening in the gold market. They always do. And we want to be positioned to profit before the next move higher.

That's why you should consider owning the metal right now. New highs are here... But much higher prices are likely in the months ahead.

Editor's Note: Bill Bonner is the Founder of Bonner Private Research and owner of the Agora Companies. This article was originally published by Bonner Private Research on March 12, 2024. You can subscribe to Bonner Private Research here.

The Inside Story

Unfair Prices

By Bill Bonner

Finally, Joe Biden is going to tackle inflation in the time-honored way of despots and crackpots everywhere.

CNBC:

"President Joe Biden will launch a new strike force jointly led by the Federal Trade Commission and Department of Justice, to tackle “unfair and illegal” corporate pricing, which he blames for consumers’ continued high costs of living.

The FTC and DOJ have been among the central enforcers of Biden’s regulatory agenda over the past three years."

In other words, price hikes don’t come from the Fed’s zero interest rate policy (ZIRP) nor from their stimmies, deficits and money-printing. High prices are the fault of evil, greedy corporations. And now, Team Biden is going to do something about it.

‘Uh…like what?’ you might want to know.

Easy. It is going to pretend that it knows what a ‘fair’ price should be. And the saintly and all-knowing feds are going to impose their will on those SOBs in the private sector.

Wasting Our Time

Of course, the SOBs will always want to charge as much as they can get away with. What stops them is not the price posses of the federal government, but competition. You either compete on price or on quality, usually both. So corporate deciders are always looking for ways to cut prices…not raise them. That is how they hope to keep their customers.

But no need to waste our time explaining these things to the Biden Bunch. If there is a lamb left unsheared in the Republic, they go after it…eager to get more wool to pull over voters’ eyes.

We asked yesterday, why does a good system degenerate into a bad one…why does government grow, becoming less democratic, more incompetent and more tyrannical?

You might as well ask why doesn’t tomorrow turn into yesterday? Or wine turn back into grape juice?

Why doesn’t the president just ‘walk across the street’ …and tell Congress: ‘Enough is enough. No more deficits. That’s it.’?

Outta Shape

You see an old man, bent, shuffling…you might say to him: ‘Just straighten up and walk normally.’ But he can’t do it. His muscles …his bones…his brain – all have taken a new shape. They can never again be what they were.

And the US has aged…and matured, too, along with its deciders. Bent by time, now the voters elect Biden or Trump, not Jefferson or even Eisenhower. And Joe Biden is so practiced as skirting the truth, he can’t do anything else. Yes, greedy corporations cause price increases…of course they do. Yes, the firepower industry needs more money to protect our democracy, of course it does. And don’t even think about trimming Social Security, Medicare or other ‘entitlements.’

“Not on my watch,” said the president on X yesterday.

It’s a shame Biden doesn’t have an older, wiser brother. Before his State of the Union Speech last week, he might have talked some sense into him:

“Joe. This is your last chance. Your career is almost over. You can go out as a washed-up hack. Or you can go out there and tell the voters something important. Stop carrying water for the special interests who want war and deficits. Stop this mumbly-fumbly double talk. The US can’t afford to keep spending money this way. If it doesn’t make a major course correction, it will soon be as washed up as you are. Tell the truth. Americans will be so shocked and delighted, you might win another 4 years. And even if you lose, you will be remembered, and honored – like Eisenhower – for saying what needed to be said. Go ahead. Give truth a chance.”

Nothing at All

And so, perhaps when the fateful hour arrived, his mind clear…his aim sure…Joe Biden might have given it to the public, straight. Unadorned by mendacity. Undiluted by wishful thinking. And unabridged by lies:

“My fellow Americans, I don’t have time for a lot of BS. So, here’s the story. If we keep spending money the way we’ve been spending it, we will go broke. Of course, there are a lot of people who don’t care about that. The money is headed their way. They’re building their mansions and stocking their bank accounts, at your expense. And the only way to stop it is just to draw a line. I can’t haggle over every line item. Besides, my job is not to protect the special interests…it’s to protect the general interest...the national interest. My job is to make sure we don’t spend too much. So, if I am elected to serve you for 4 more years – and yes, I know I don’t really deserve it – balanced budgets will be non-negotiable. No more deficits. No more money printing. You gentlemen and ladies in Congress…you decide what to spend money on…and send me a balanced budget. I’ll sign it.

“Otherwise, don’t bother to send me anything at all.”

|