It is typical for younger investors to hold riskier portfolios than older investors because the...

Gold Isn’t the Only Way to Diversify Your Portfolio

Gold and silver have been in a holding pattern for some time now, trading within a relatively narrow range. Spot prices are held down as interest rates remain high and the dollar shows relative strength, but propped up by safe haven investors while geopolitically instability is shaking the Middle East and Europe.

But what about the other white metals? Platinum and palladium make up a smaller portion of the precious metals investing space, but offer diversity in a portfolio just the same.

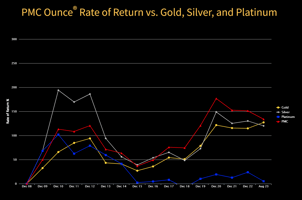

In the last bull market, gold and silver’s upward momentum gave palladium and platinum a boost as well. The precious metals markets are impossible to time, and investors should continue to put faith into gold, or even consider diversifying into all four major precious metals. Since the four major precious metals markets are driven by unique supply and demand factors, diversification can allow you to minimize volatility and maximize returns.

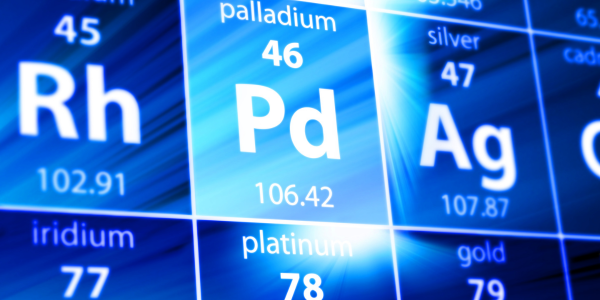

Palladium Crashed

Palladium, a member of the platinum group of metal, is 30 times rarer than gold, but sold at substantially lower price per ounce for most of its history. Over the past few years, a sustained supply deficit coupled with robust demand and rising interest from speculators pushed prices of palladium to new highs. At the peak, palladium touched above $3,000 an ounce in the spring of 2022. Unfortunately, palladium has gradually come back down pre-rally levels.

Russia is one of only two countries in the world primarily responsible for the vast majority of palladium production and mining. With the Russian invasion of Ukraine, one would have expected the supply to be limited and possibly even inaccessible at times going forward, driving prices up. However, the stock market’s turbulence swept palladium up in the larger sell-off in the commodities space.

Palladium is essentially flat for February, down less than a dollar, after tumbling 11% in January and advancing 8.6% in December. Palladium plummeted 38% last year. Because it is such a thinly traded market, palladium spot prices are prone to volatile swings to the upside and the downside.

Auto production growth may be marginally positive for palladium demand going forward, but it’s unlikely that we’ll see palladium return to 2022’s highs. Palladium currently sits around $970 an ounce.

Platinum Moved Marginally Lower

For most of its history, platinum traded at a higher premium to gold. In recent years, it was eclipsed by its sister metal palladium and dropped far below gold’s pricing, despite being 10 times rarer than gold. Analysts predict an eventual return to a dominant status in the future due to platinum’s high value in industrial usage; its rarity and limited supply should lead to price increases going forward.

Yet, platinum is trading at less than its historic average value. Today, gold is trading for around $2,030. If platinum traded in line with its historic premium over gold, then platinum should be trading for well above $2,500 an ounce.

Instead, platinum dropped 6.8% 2023. Platinum is down 2.2% so far this month after falling 8% in January and rising 8.1% in December.

The long-term platinum outlook is a little stronger as it is a key element in the emerging green economy. Taking into consideration current industrial demand combined with shrinking supply surplus, platinum may soon have a place to shine in every bullion portfolio. Platinum currently sits around $890 an ounce.

Diversification is the Way to Go

Whether spot prices for platinum and palladium are set to fall further from here, or rise over the long-term, the current price levels of platinum and palladium are quite attractive, considering future growth. Global demand for automobiles is up 8.9% over the previous year, which may lead platinum and palladium to be highly sought after for industrial purposes. If diversification is one of your goals, adding platinum and palladium in small amounts, in addition to gold and silver, could be beneficial to your portfolio.

To take advantage of today's lower spot prices in platinum and palladium, please call us at 800-831-0007 or email us. Or visit www.assetstrategies.com to shop platinum and palladium sovereign coins and bars today!