Spotlight.

Why Bother with Numismatics?

Coin collecting can be a very profitable venture when done the right way, and numismatics make a great alternative asset for those looking to diversify their portfolio.

Investors like pre-1933 U.S. gold coins for their track record of outperforming generic gold bullion in times of uncertainty. This was especially true in choppy markets like 2009 and 2013.

What is the difference between bullion and a numismatic coin?

Unlike bullion, numismatic coins are not an investment in the typical sense. Although used as a store of wealth, their value is not always associated with the metal content spot price. In fact, numismatic coins are generally worth more than their bullion counterparts.

There are many ways to collect coins. The simplest way is to save coins found in circulation, and this is how many of the greatest collectors got their start.

However, coinage with gold or silver content is extremely unlikely to be found in circulation, and collectors interested in coins composed of precious metals are unlikely to find anything of significant value in circulation. Owning numismatic coins with precious metal content is a savvy way to turn coin collecting from a hobby to an investment strategy. Rare coins, in particular, make for prizeworthy pieces in a collection and an investment with potential for growth.

Starting Your Collection

As you begin to amass your collection, you should know that many collectors like to organize their collection based on value, historical significance, eye appeal, rarity, and condition. These are some common types of collections:

- Date set: a complete set of every date and mintmark issued of a particular coin design.

- Type set: a set that includes one example of each coin design, such as a collection of every one-cent coin design issued by the United States.

- Thematic set: a collection focused on a particular theme — for example, cats or ships on coins.

- Variety set: a date set that includes different varieties of each date and mintmark combination. Varieties are differences in the dies used to strike a particular issue. Variety sets are more challenging than other types of sets, and are often built by more advanced collectors.

Structuring your collection can help you decide what direction to go when you’re “on the hunt” rather than being overwhelmed by the many numismatic coins on the market. Coins from ancient times all the way to modern day can be collected on any budget because prices depend on their rarity, survival rate, condition, and eye appeal.

What’s in a Name

If investing in coins purely for their numismatic value, it’s important to deal in certified coins only. It can be difficult to determine the value of a coin purchased from an eBay auction, whereas certified coins guarantee a certain level of quality and will be easier to resell. Certified coins are those which have been inspected and graded by a recognized organization such as the Numismatic Guaranty Company (NGC) or the Professional Coin Grading Service (PCGS), then placed in a protective holder, known as a slab.

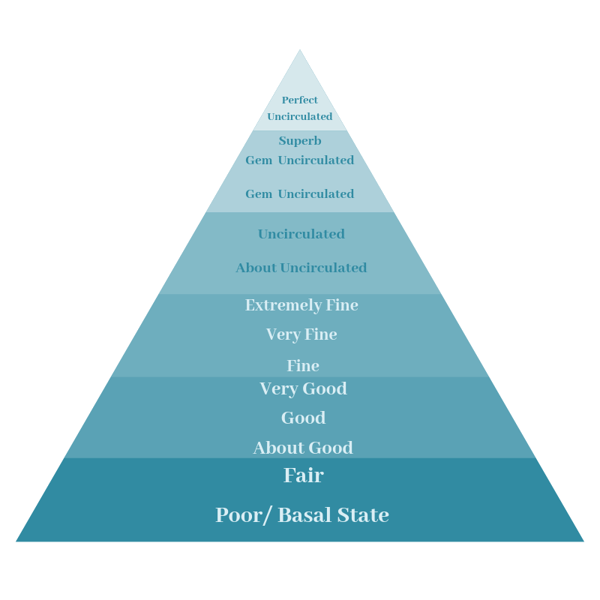

With certified coins, it is important to understand what is meant by a coin’s grade. Based on condition, coins can be graded from Poor, at the lowest end of the spectrum, all the way up to rare and pristine Gem Uncirculated. In addition, many appraisers use the internationally accepted Sheldon grading scale of 1 to 70, which was first used in the United States in the late 1940’s. The higher the number, the better the grade of the coin, and the more it will be worth at auction or on the open market.

Certified coin grades from best to worst are as follows:

- Perfect Uncirculated (MS-70)

- Superb Gem Uncirculated (MS-67, 68, 69)

- Gem Uncirculated (MS-65, 66)

- Choice Uncirculated (MS-64

- Select Uncirculated (MS-63)

- Uncirculated (MS-60, 61, 62)

- About Uncirculated (AU-50, 53, 55, 58) Sometimes referred to as Almost Uncirculated.

- Extremely Fine (XF-40, 45) Also commonly abbreviated as EF.

- Very Fine (VF-20, 25, 30, 35)

- Fine (F-12, 15)

- Very Good (VG-8, 10)

- Good (G-4, 6)

- About Good (AG-3) Sometimes referred to as Almost Good.

- Fair (FR-2)

- Poor (PO-1) Also known as Basal State.

Rare U.S. Coins

In particular, rare U.S. coins are a commodity like few others, and there is a limited supply available. Rare coin prices are determined by what is sold around the world and rises as investors and collectors pay more for these increasingly rare items.

As a long-term investment, rare U.S. gold coins are the next step to achieving the same benefits of portability, privacy, market performance and currency protection as precious metals. Rare coins are an asset class not correlated to other mainstream, traditional assets and therefore largely unaffected by volatility and downturns in other markets.

- Uncorrelated asset.

- Value varies based on the internal rare coin market.

- Provides liquidity.

- Pass value into the future as a legacy item.

- According to the Knight Frank Luxury Index, one of the least volatile investments you can own.

- Affordable storage options available.

- World renowned third-party standardized grading services (PCGS & NGC) used to authenticate and verify condition on every coin acquired.

Rare U.S. coins are exciting ways to own a piece of our nation’s history and a sound addition to a diverse portfolio.

Bridging the Gap

Bridging the Gap

Between standard bullion and numismatics, we also have what is referred to as Junk Gold or Junk Silver.

Junk Silver refers to pre-1965 dimes, quarters and half-dollars which still have a 90% silver content, which makes their worth higher than their face value. As an asset, they’re easily divisible, have widespread recognition, and boast great value for both investment and survival purposes. Today, a $100 face value bag of pre-1965 coins will net about 71.5 ounces of pure silver when melted.

Junk Gold are circulated pre-1933 gold coins which are similar in age and type to numismatic coins, but they do not have as much potential for additional value above their melt price due to their common nature and visible wear and tear from circulation.

They’re a great way to own gold with a fascinating history attached at a lower cost.

How do I Invest in Numismatics?

Those considering collecting numismatic coins as a more serious portfolio investment should get excited because they offer a unique combination of tremendous upside potential along with an extremely low level of volatility. However, there’s a lot of misinformation out there. Counterfeit is common and difficult to detect unless you’re an experienced numismatist. Additionally, there are unsavory dealers who do not have your best interests at heart.

The good news is…you won't have to go it alone when choosing rare numismatics for your portfolio.

When the market presents the opportunity, we select a Spotlight Coin or Coin Set to highlight for your perusal, providing in-depth analysis on its value and history. The process of researching, finding, and selecting coins worthy of the Spotlight title takes months of effort before an offer is released to you. However, we only release a limited number of coins or sets as they must meet specific criteria for value. We want you to buy the “Right Coin at the Right Price” for your portfolio, your goals, and needs.

In addition to U.S. numismatics, we occasionally are able to offer small, selective groups of world and ancient coins.

Our Spotlight frequently sells out, so email us to subscribe to our numismatic alert list for FREE for first access to rare coin offers and to continue learning about the fascinating world of numismatics.